🌌 Reshaped #50

EV boom, China's economic growth, US climate ambitions, technoscientific assetization, climate-driven space tech and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

🎙 There is a new podcast in town! My friend Matthieu and I recently launched The DART Bullseye, a weekly podcast on innovators, entrepreneurs and investors. You can listen to it on Spotify and Google Podcasts. In this week’s episode, Matthieu had an interesting conversation with Pung Worathiti Manosroi, Founder and Chief of Product at Betterfront.

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

Policy

Industrial policy

While the Western world struggles to design and implement recovery plans, the Chinese National Bureau of Statistics reported a 2.3% annual GDP growth, with a 6.5% rise in Q4 only (The New York Times). The growth pattern is irregular and rewarded primarily blue-collar workers — which is normal when macroeconomic shocks on labour-intensive sectors meet countercyclical public spending. Nonetheless, it could be enough for China to surpass the US in GDP terms sooner than expected.

While the recovery remains uneven, factories across China are running in overdrive to fill overseas orders and cranes are constantly busy at construction sites — a boom in exports and debt-fueled infrastructure investments that is expected to drive the economy in the coming year. […] Jobs abound for blue-collar workers, but have been scarce for recent college graduates with little experience.

This fast recovery comes at a cost. Geographic inequality between the North and the richer South is on the rise (The Economist), while local bubbles require regulatory measures with domino effects on downstream sectors — it is the case, for instance, of the real estate lending cap set by the government (South China Morning Post). In a country where the social contract is based on the promise of long-term growth (see Reshaped #15), however, this is an outstanding result for the stability of the current power relationships.

How will the Biden administration react to the apparently unstoppable growth of the Chinese economy? The starting point might be to reverse Trump’s failed trade war with China, which ultimately resulted in the latter further increasing its trade surplus with the US (Bloomberg). In a recent ITIF report, Robert T. Adkinson advocates for an aggressive technological foreign policy that, however, seems distant from Biden’s multilateral agenda.

The United States needs to move away from an idealist view of digital international relations to a new doctrine of “digital realpolitik” — focusing more on protecting key U.S. interests rather than acting as a global ambassador of Internet openness. The new doctrine needs to move away from the idealist’s dream of a harmonized, values-based global Internet, as this is clearly not going to happen. It also needs to move away from principally unilateral action.

A recent article on Brookings, on the opposite, focuses on the need to counterbalance the rise of Chinese R&D spending through long-term vision and government intervention to boost innovation opportunities.

While free markets are foundational to creating opportunities for entrepreneurship and advancement, government intervention can catalyze continued economic development. […] The lesson to be learned from China’s R&D is that progress requires long-term investment in human capital and physical capital, and that making such investments—or not making them—can have major consequences for a nation’s wellbeing.

➡️ An interesting paper reports that “countries behind the innovation frontier might strengthen their resilience to economic crises by adopting countercyclical R&D strategies”, which would balance the reduced private R&D spending in times of crisis.

Climate policy

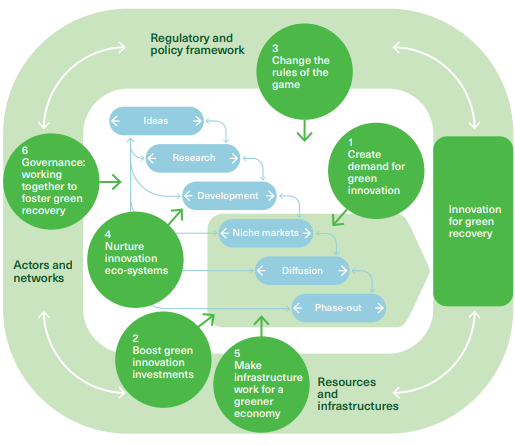

A new report by the UCL Green Innovation Policy Commission shed light on how to build effective partnerships between governments and businesses to foster green innovation. The authors defined six priorities for policymakers (see picture below). Not surprisingly, public procurement aimed at boosting demand for green innovation is a core component of the policy mix. This is fundamental to align incremental and transformational goals (see Reshaped #49). Indeed, “innovation policy needs to find a balance between quick and slow ‘wins’ by investing in both a wider diffusion of proven green technologies and supporting novel, often disruptive, innovations”.

This is consistent with the recommendations of a recent report by Columbia SIPA researchers on how to structure demand-pull innovation policies in energy markets.

Demand-pull innovation policies focus narrowly on creating and shaping early markets for emerging technologies. For example, targeted government procurement, prize competitions, or milestone payments can provide early markets for clean energy technologies that have been developed with the aid of public RD&D funding. The government can also coordinate private procurement or otherwise catalyze private market adoption through certification and standard-setting processes. Such demand-pull innovation policies have extremely high leverage and have transformed limited public investment into flourishing private commercial markets across the space, medical, and energy fields.

Meanwhile, Joe Biden is starting to reverse Trump’s climate indifference. On Wednesday, he signed executive orders that will make the US rejoin the Paris climate agreement and revoke the federal permit for the Keystone XL oil pipeline (Scientific American). More importantly, the new administration will try to make market-based instruments (mainly cap-and-trade schemes and carbon taxes) more efficient by increasing the cost of polluting, approaching the optimal carbon price (The New York Times).

He also is expected to begin the process of forcing agencies to calculate the costs that carbon dioxide emissions impose upon society. By raising the costs of climate change, the Biden administration hopes to change cost-benefit analyses in a way that makes strong regulatory action more economically appealing and less susceptible to negative court rulings […].

➡️ The French central bank announced that it will “exit from coal and limit exposure to gas and oil in its investment portfolio by 2024” (Reuters).

➡️ Total announced the acquisition of a 20% stake in Adani Green Energy, the world’s largest solar developer, for $2.5 billion (The Wall Street Journal).

Technology

Electric vehicles

One of the main concerns about the diffusion of EVs is their high upfront cost, which discourages consumers from switching to electric cars. However, a new study by MIT researchers reveals that EVs are not only good for the environment but also cheaper than traditional vehicles in the long term (see chart below). The EV stock (and SPAC) boom is partially explained by the expectation that new environmental regulations will favour an increase in the demand for EVs in the medium term. Provided that this is enough to solve the affordability issue, EV companies would still have to face a major economic hurdle: the high infrastructural cost of the transition.

In the US, the infrastructural problem is part of Biden’s sustainability agenda. As reported by Axios, “Biden’s energy platform calls for the construction of 500,000 new public charging stations by the end of 2030”. Of course, this means not only working on the availability (quantity) but also on the technology (quality). In South Korea, Hyundai is working to convert old gas stations into a collection of ultra-fast chargers “capable of delivering 350 kWh of power, and peak at 800 volts” (The Next Web). At the same time, in the US, the charging company EVgo is going public via SPAC acquisition to consolidate its leading position in the car charging segment (The Verge). In Europe, Renault and Scania are working on dynamic charging techniques that allow users to charge vehicles as they move (The Wall Street Journal).

Several automotive, utility and infrastructure companies are testing technology that promises to allow electric cars, buses and trucks to charge on the move. The process, known as dynamic charging, involves under-road pads that wirelessly transmit electricity to receivers mounted underneath cars and, for some larger vehicles, overhead wires like those used by trams.

Meanwhile, as reported by BloombergNEF, energy transition investments hit the record amount of $501.3 billion in 2020 (+9% vs. 2019). The most valuable insight, however, is that electrified transport (EVs and charging infrastructure) accounted for $139 billion, a fast-growing share of total energy investments (see chart below). In a recent tweet, Varun Sivaram smartly points out that “we’re approaching the point where direct end-customer investment (eg buying EVs) outstrips investment in clean energy by intermediaries (eg renewable energy developers)”.

➡️ Stellantis, the result of a merger between FCA and PSA, announced the launch of ten EV models in 2021 (CNBC).

➡️ Tesla started the commercialization of its made-in-China Model Y to “save on shipping costs and avoid import duties for the Chinese market” (The Wall Street Journal).

➡️ Sony’s Vision-S project is a concept aimed at testing EV technologies for a potential market entry.

Big Tech

We entered 2020 at the peak of the techlash sentiment. With the pandemic outbreak, a diffused feeling of resignation emerged in front of the resilient power of tech giants. Now, according to The Economist, “a dawn of technological optimism is breaking”.

After 2000, though, growth flagged again. There are three reasons to think this “great stagnation” might be ending. First is the flurry of recent discoveries with transformative potential. […] The second reason for optimism is booming investment in technology. […] The third source of cheer is the rapid adoption of new technologies. […] Although the private sector will ultimately determine which innovations succeed or fail, governments also have an important role to play. They should shoulder the risks in more “moonshot” projects.

This is probably not the kind of grounded forecast that will change your day. Yet, reading about the positive role of pro-cyclical government policy in this magazine is not so usual. Meanwhile:

Netflix announced that it is close to being free cash flow positive and that it will not make use of additional external capital to finance its operations. This is a major step for the company, which will soon buy back part of its stock (Financial Times). And it is also a relevant lesson for startups adopting subscription-based business models: it took Netflix 200 million users to be financially sustainable.

Apparently, Facebook gave up on a new way of selling online advertising because it was offered a deal by Google (The New York Times). The deal “renewed concerns about how the biggest technology companies band together to close off competition”.

Google researchers developed a 1.6-trillion-parameter model that could be the most advanced ML model ever built (VentureBeat).

Amazon will allow automakers to access the AI platform behind its Alexa digital assistant through licensing deals (The Verge). Third-party companies will have the chance to customize Alexa for their own purposes.

➡️ Michele Foradori provides some very interesting insights in his 2021 Fintech and Insurtech predictions.

➡️ Loon, one of Google’s moonshot projects, was shut down because there was no way to cut costs enough to make it a sustainable business (The New York Times). Loon “used high-altitude helium balloons to deliver cellular connectivity from the stratosphere”.

Space tech

The greater focus on climate change could rapidly boost space tech investments, thanks to the benefits that satellite constellations could provide in supporting accurate climate monitoring. According to Bloomberg, the European Space Agency has taken the lead in financing climate-related space projects, with a growing number of satellites dedicated to monitoring the planet, providing open-access data to scientists and building reliable simulations

The data collected by European satellites is at the heart of the continent’s multibillion-euro Destination Earth program seeking to develop the world’s best digital simulation of Earth. […] By using artificial intelligence and supercomputers, the first digital-twin simulations of Earth could be ready by 2028. […] The new tools will enable researchers to drill down and detect changing patterns within a kilometer area, compared with about 10 square kilometers at present.

Space tech could also help scientists track animal movements more efficiently. The European ICARUS project “could fundamentally reshape the way we understand the role of mobility on our changing planet” (The New York Times). By applying new tracking devices that send data to the International Space Station, scientists will have the possibility to constantly monitor the movement patterns of wild species and answer critical questions such as “the locations where they perish, the precise pathways of their migrations, their mysterious radiations into novel habitats”.

➡️ Last week, Donald Trump signed a directive aimed at reinforcing the American GPS infrastructure’s accessibility, performance and cybersecurity (Space).

Finance

Venture capital

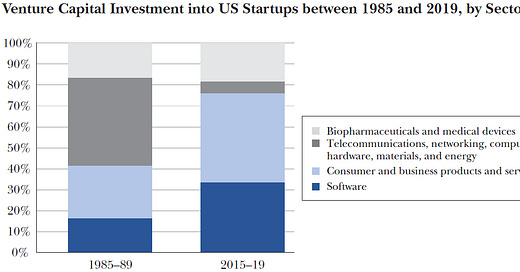

A recurring topic of this newsletter is the growing relevance of climate tech VCs (see Reshaped #46 for a recap of last year’s numbers). This week, Bloomberg reported that Bill Gates’ Breakthrough Energy Ventures raised a new round worth $1 billion to finance 40-50 startups working to solve some of the most pressing climate issues. At the same time, Elon Musk announced a $100 million prize for designing effective carbon-capture technology (Business Insider). There is a widespread consensus among tech analysts and investors regarding the need for new technological paradigms aimed at fighting climate change (see, for instance, Azeem Azhar’s recent piece for Wired). However, this seems to be a radical shift from the tendency of VCs to concentrate investments in downstream ventures during the last couple of decades (see picture below).

Past climate tech waves produced no relevant result also because of this behavioural pattern: when VCs have low-cost and low-risk alternatives, they do not engage in transformational technology investments (see Notes on climate tech in Reshaped #49). Today, however, there are at least three factors driving attention and money into climate tech ventures:

The space on top of the existing internet infrastructure is reduced. This was brilliantly explained some months ago by John Luttig, who forecasted the securitization of Silicon Valley and the emergence of venture debt instruments.

The growth of SPACs, which managed to bring to public markets startups with embryonic revenue models, entails the possibility to exit when technological risk is not fully mitigated.

The increased attention of policymakers means not only that part of the risk will be absorbed by public finance but also that regulatory schemes will reward first movers to the detriment of new entrants. This is even more relevant when the “infrastructure phase” is still far from completion.

➡️ Rivian, an EV startup backed by Amazon and Ford that is working on an all-electric pickup, raised $2.65 billion at a $27.6 billion post-money valuation (CNBC).

➡️ EV startup Cruise raised $2 billion in a new round (that includes Microsoft) at a $30 billion valuation (TechCrunch).

➡️ The UK-based, Amazon-backed food delivery startup Deliveroo raised a pre-IPO round worth $180 million at a $7 billion valuation (Business Insider).

The big picture

Can capitalism still be read through the lenses of gradual commodification? Is Karl Polanyi’s Double Movement still applicable? In Assetization: Turning Things into Assets in Technoscientific Capitalism, edited by Kean Birch and Fabian Muniesa, authors argue that, in technoscientific capitalism, assetization has replaced commodification as the major trajectory of capital deployment. Hence, the asset, “anything that can be controlled, traded, and capitalized as a revenue stream”, is the basic constituent of the innovation economy. The risk, they write, is that this favours rent-seeking behaviour to the detriment of productivity growth.

The prevalence of processes of commercialization and privatization have repeatedly motivated a reading of technoscientific capitalism as a commodification movement that orients science and technology toward a market destiny. [… Instead,] the dominant form that technoscientific capitalism affords is not the commodity but the asset, and […] the financial contours it entails are not those of market speculation but of capital investment. […] Intriguing things are going on indeed […] as a consequence of an emerging “asset form” that has come to replace the commodity as the primary basis of contemporary capitalism. […] The asset form reflects the tumult in contemporary technoscientific capitalism, in which it becomes harder and harder to draw clear boundaries around what counts as or comes to constitute capitalism.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico