🌌 Reshaped #49

Climate tech challenges, tech M&A regulation, global VC records, IPO bonanza and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

This week, I am briefly diving into climate tech risks and priorities. See also the recent report on global VCs in Finance.

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

Notes on climate tech

Jerry Neumann’s piece on productive uncertainty stimulated an interesting debate about deep tech investing, with a special focus on climate tech. At the core of his argument, there is the idea that VCs tend to avoid technical risk because of the uncertainty it entails.

Investors need companies that don’t have much competition to start and that can build moats to prevent competition later. Startups whose success is predicated on a new, better technology rarely make the transition from innovator to dominant player. Technology in itself is usually not a moat, and companies that are based on introducing new technologies rarely get to build moats. Investors need to invest, instead, in companies that are entering new markets.

In particular, many startups emerged during the last climate tech bubble (2006-2011) “were victims of novelty uncertainty” and “were competing with existing solutions”. Due to lower technical risk, VCs tended to prefer the latter. I found Neumann’s post very interesting (even if some of his concepts were already explained by Kenneth Arrow in his economic research). However, there are some aspects to consider when approaching the new climate tech wave.

1. Technological innovation is not optional. The idea that existing technologies are enough to drive the necessary changes to fight climate change is now globally rejected. See, for instance, Varun Sivaram’s Taming the Sun: Innovations to Harness Solar Energy and Power the Planet.

2. Climate tech is urgent. Differently from other sectors, climate tech is affected by one more variable: urgency. Emission reduction targets are a sword hanging over our heads that even the boldest mission-driven innovation programs of the past have never faced — which, in turn, would make a new bubble unsustainable (see Reshaped #40).

3. Capital needs to be allocated accordingly. To reflect the need for different types of investments, capital should be allocated into four main categories (see picture below): political expenditures, climate mitigation (transformative and low-cost/incremental) and revenue recycling. Lobbying expenditures could make current “pork” investments at least functional to better capital allocations.

4. Green finance should be aligned with low-cost investments. Green finance instruments should focus (at least) on sectors in which the cost curve has started to move downwards, such as energy. See, for instance, Max Roser’s extraordinary piece on how renewables became so cheap so fast. Before scepticism towards green finance turns into backlash, it is absolutely necessary that it achieves its ultimate goal: moving capitals into projects that would not be funded otherwise. In this scenario, public finance would find its own place as well, with development banks tasked to maintain a strong public share in the new industries (see, for instance, the case of Japan investing to grow its own wind sector on Nikkei Asia).

5. Move public funds into transformational opportunities. To replicate the learning curve path experienced in energy markets, it is fundamental that public funds are moved into transformational investments. At the moment, the most advanced program in this field is probably Stripe Climate, which aims at boosting demand for carbon capture and storage (CCS) technologies to cut costs. On top of public investments (especially public procurement), other private actors (VCs included) would probably be willing to accept the uncertainty level carried by cleantech startups. A lack of alignment between public and private finance in transformational investments would generate a result similar to that of the last cleantech bubble.

6. Incentives should be set flexibly. Historically, public finance has had two main roles: improving private returns through tax exemptions and reducing risk by acting as a co-investor or an early buyer (again, the role of public procurement is crucial). To make investment flows stable and reliable enough, incentives should be set flexibly in order to create sustainable and productive rewarding mechanisms. In addition, this would prevent the risk of picking the wrong winner and sponsoring a sub-optimal technological standard.

Policy

Antitrust

One of the greatest areas of concern of the antitrust cases against tech corporations is their M&A pattern, which is under attack for stifling competition and restraining innovation. As I wrote months ago, the rising M&A activity of Big Tech companies in the last couple of decades (see chart below) has already generated permanent effects in the innovation economy. Startups build their business models in ways that can enhance their chances of getting acquired — which is particularly relevant when the IPO window is narrow. The possibility of a sharp reduction in tech M&As deriving from fears of antitrust scrutiny is worrying investors and could impact startup valuations in the medium term (TechCrunch).

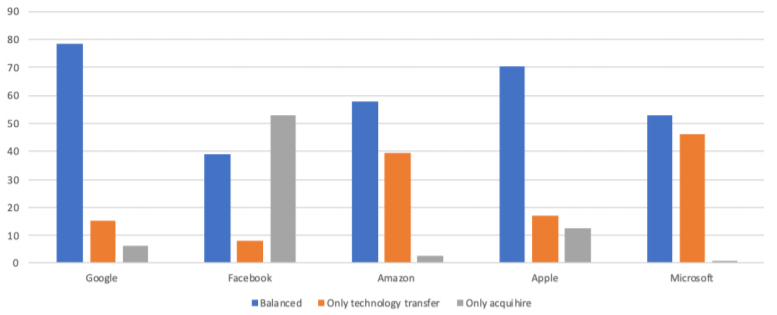

A new paper explores the acquisition path of the five major technological companies, with some recommendation for regulators in this domain. The reasons behind M&A deals (see chart below) is particularly interesting. For instance, it shows how Facebook tends to acquire companies to hire talents while Amazon and Microsoft have more tech-oriented acquisition behaviour. (The balanced column refers to deals that encompass both tech and talent acquisition goals). Authors recommend better ex-ante antitrust scrutiny and an update of merger enforcement tools, such as measuring “the substitutability of platforms’ services during the merger evaluation and how it evolves over time”.

This is even more relevant as Big Tech companies have virtually no financial constraints, which are among the major mitigation factors of M&A waves arising from imitation behaviour (see, for instance, this recent paper on the topic).

➡️ In the last episode of Capitalisn’t, Luigi Zingales and Bethany McLean interviewed Robert Topel and David Boies to compare the antitrust case against Microsoft (1998) with that against Google (2020).

Technology

Space tech

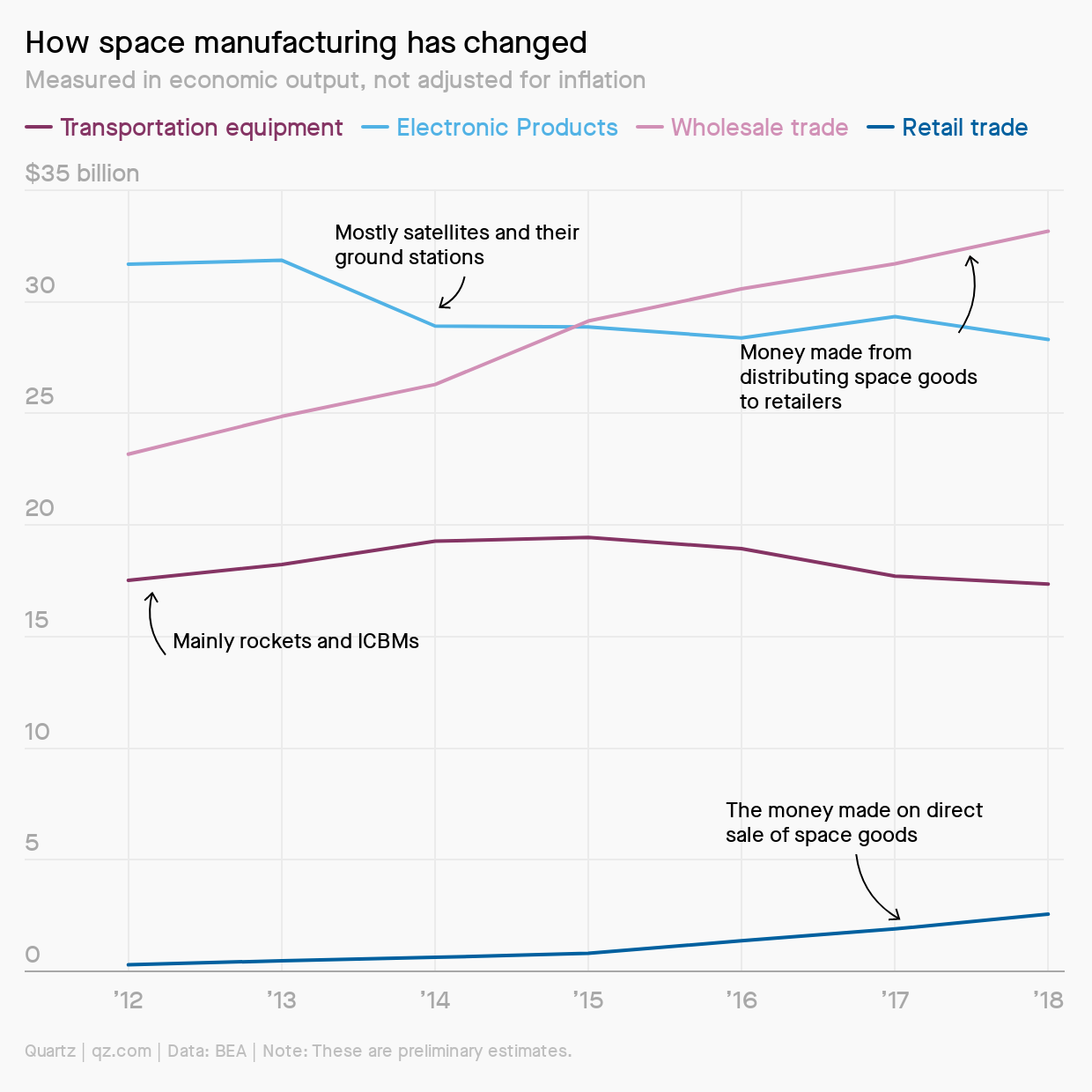

As reported by Quartz, the US Bureau of Economic Analysis has estimated the total value of the American space economy (see PDF), which “produced $178 billion worth of goods and services, employing some 356,000 people in the private sector” in 2018. A very interesting aspect of the analysis is the manufacturing trend (see chart below), which shows a decline in hardware economic output for both transportation and electronics. This is partially explained by falling prices due to productivity gains and — my guess — to the lack of a global standard in many of the hardware products of the space economy. This increases competition in the R&D phases that anticipate go-to-market, which is also naturally fostered by public procurement. On the opposite, wholesale and retail trade services are on the rise, which is a very positive indicator.

Besides, the report also explores the relationships between the space economy and other sectors of the US economy. Its widespread diffusion from primary sectors to manufacturing and services is impressive.

Although space economy gross output is concentrated in a couple of sectors, space activity can be seen in essentially every major sector of the U.S. economy. Many of the relatively small sectors in the space economy, such as agriculture, forestry, fishing, hunting, mining, and utilities, reflect production related to research and development (R&D) and remote sensing software and services.

➡️ On The Wall Street Journal, Christopher Mims explores the rising market behind small satellites, with some interesting startups I reported about during the last couple of months.

Big Tech

Some updates from tech corporations:

To effectively challenge Spotify, Apple is planning to launch a subscription service for its podcasting platform (The Information). This makes sense as Apple is struggling to keep up with competitors in podcast revenue generation (see Reshaped #47 for more on Amazon’s strategy in this sector).

Parler, the conservative alternative to Twitter, filed a suit against Amazon, which had previously kicked it off of its web hosting service for inciting violent behaviour (NPR). Should providers of internet infrastructure services apply the same content moderation principles of social media companies?

Pat Gelsinger, Intel’s newly appointed CEO, will have to make important decisions to fill the gap with direct and indirect competitors (The Verge). One of the most critical is about whether to separate chip design and manufacturing (as recommended by active investor Daniel Loeb) or not. Among the options, there is also the possibility for Intel to outsource part of the manufacturing process to other companies.

➡️ Due to potential antitrust troubles, Visa renounced to acquiring Plaid in a previously agreed deal worth $5.3 billion (TechCrunch).

➡️ World Wide Web pioneer Tim Berners-Lee has a plan to revolutionize how data is collected and managed by online giants (The New York Times). For more about the different approaches to data regulation, see Salomé Viljoen’s piece on Phenomenal World.

Finance

IPOs

Let me start this section with a due, short update about last week’s excursus on the stock bubble. On Monday, John Authers provided a clever analysis of the main features of the bubble (Bloomberg), with a comment on Jeremy Grantham’s recent predictions about the potential end of the bubble in a few months (which you can read on Barron’s).

There are (valid) arguments that the entire market isn’t in a bubble. There are also (very valid) arguments that it is difficult for stocks to fall far while bond yields remain historically low, and that there are strong forces preventing yields from rising any time soon. There have been incidents in the past of excessive behavior in one corner of the stock market while all else remains relatively calm. And of course there are valid arguments that Tesla could indeed be as influential and powerful a company in the future as Microsoft or Amazon are now.

This week, two more companies went public with successful IPOs:

Affirm, a fintech startup led by PayPal co-founder Max Levchin, went public on NASDAQ nearly doubling the $49 IPO price per share (MarketWatch).

Poshmark, an online clothing reseller, more than doubled its $42 IPO price with a market capitalization of about $3 billion (CNBC).

The following chart (limited to the US) is quite representative of the IPO bonanza that started during the summer. Notice that proceeds did not grow proportionately to the number of deals, which is partly explained by the small size of the companies that had access to public markets — which, in turn, is among the factors that worry the most about the financial bubble.

➡️ Curious fact: Bill Gates is now the top private farmland owner in the US (Forbes).

➡️ The US has a regulatory advantage for investors willing to raise money for their SPACs (Quartz).

Venture capital

The new MoneyTree report by PwC and CB Insights was recently released, which gives us the chance to explore some of the major trends in the VC sector in 2020:

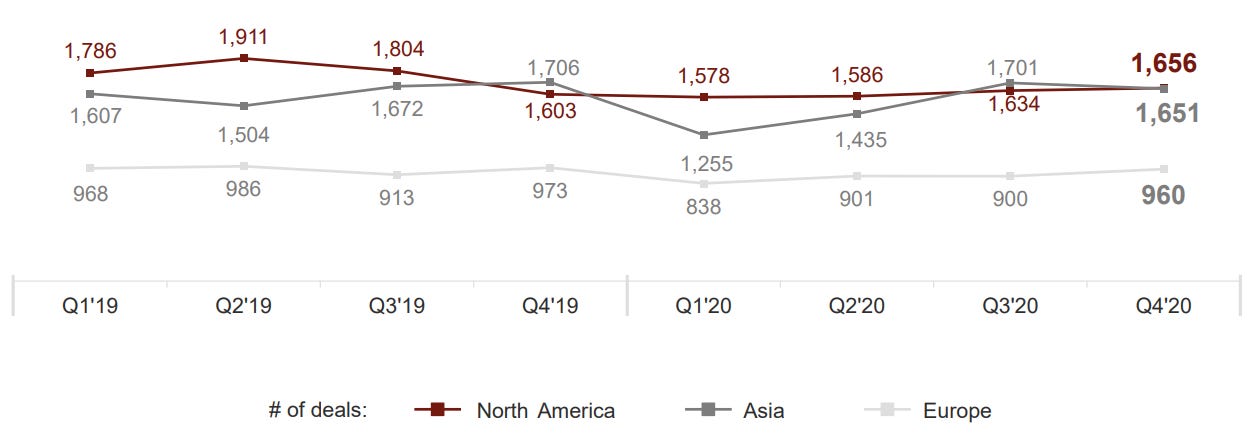

VCs invested $259.4 billion globally in 16,773 deals. The leading region in both value ($132.9 billion) and number of deals (6,454) is North America, followed by Asia ($87.1 billion in 6,042 deals) and Europe ($33.4 billion in 3,599 deals). Europe is still lagging behind, but the deal trend is positive (see chart below).

Investor fundraising is on the rise, with $1,116 billion raised (+10.4% vs. 2019).

Mega-rounds (deals worth more than $100 million) hit a new record in the US in both value ($63 billion) and number of deals (318).

The unicorn population continues to rise in the US with a total amount of 225 startups valued at $659 billion.

In the US, exits set new records as well, thanks to the IPO rush of the second part of the year and despite a drop in M&As. The total years to IPO (one of the most important metrics to gauge the state of the innovation economy) fell to 6.5 in Q4 (see chart below).

➡️ A new paper explains why “increasing competition depresses returns for reputable VCs, hurting their incentive to invest”. Very interesting read.

➡️ Tessera Therapeutics raised a new round worth $230 million (TechCrunch). The Boston-based startup developed a gene-writing service “to provide more tailored therapeutic instructions to genetic code”.

The big picture

Again, a small picture. Do you want to challenge your capitalist creed? Then you will like David Harvey’s recent article on New Left Review and Nicole Aschoff’s piece on Jacobin.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico