🌌 Reshaped #47

How to break-up Big Tech, EU-China deal, solar power from space, dancing robots, white male VC and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

Happy new year to you all and a warm welcome to the new subscribers who joined us in the last couple of weeks!

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

Policy

Antitrust

After the global awakening of antitrust policy in 2020, we can expect an intense year for policymakers worldwide. Nonetheless, the long-term horizon of the US suits against Google and Facebook means that the debate over their potential outcomes will continue to liven up the antitrust scenario at least for many months. One of the most exciting areas of research is the Chinese approach to antitrust enforcement: however, the long-term consequence of Chinese activism to regulate domestic markets could be an even stronger control of the economy by the Communist Party (Project Syndicate).

On Foreign Affairs, Zephyr Teachout, author of Break 'Em Up: Recovering Our Freedom from Big Ag, Big Tech, and Big Money, compares the current level of monopolization in technology and digital markets with the Gilded Age that characterized the late XIX century in the US. To restore economic freedom and democracy, she argues, populists and progressives should come together to break up monopolies and create digital utilities. In doing so, however, special attention should be paid to racial justice.

[…] one of the main differences between then and now is that, compared to today, fewer Americans accepted such rationalizations during the Gilded Age. Today, Americans tend to see grotesque accumulations of wealth and power as normal. Back then, a critical mass of Americans refused to do so, and they waged a decades-long fight for a fair and democratic society. On the other hand, today’s antimonopoly movements are intentionally interracial and thus avoid a massive failure of the populists and progressives of the late Gilded Age, who abandoned Black Americans even though they had played a crucial role in fostering both movements.

Economies of scale at a global scale, however, could make the “break-up option” difficult to implement without major consequences for consumers. A new paper by Herbert J. Hovenkamp explores in detail the options at hand for policymakers, including ownership/management (rather than asset) break-ups and interoperability.

Sometimes the best way to deal with platform monopoly is to break up ownership and management rather than assets. Leaving the platform intact as a production entity but making ownership more competitive could actually increase output, benefitting consumers, labor, and suppliers. […] A second possibility is forced interoperability or pooling of important information, which can make markets more competitive while actually increasing the value of positive network externalities.

➡️ On The Baffler, Josh Gabert-Doyon explains how tech monopolies differ from that of tobacco.

➡️ For the first time, the US approved new standards regulating airplanes emissions (Reuters).

Innovation policy

On Wednesday, the EU and China signed the EU-China Comprehensive Agreement on Investment (CAI), which is “the most ambitious agreement that China has ever concluded with a third country”. The deal will allow European companies to have greater and more secure access to the Chinese market and will eliminate quantitative restrictions, equity caps and joint venture requirements for FDIs in a large number of sectors — this is particularly relevant for sectors like automotive and manufacturing, which represent the majority of European FDIs to China. The agreement forces China to increase transparency in how state-owned enterprises (SOEs) run their businesses and how subsidies are structured while ruling against any forced technology transfers and forced labour in the country.

This is a major blow for the US in its attempt to take under control any relationship with China in the Western world. The deal, however, is a fundamental milestone for the European commercial strategy. Despite the announcements by Chinese authorities to level the playing field, indeed, European companies have continued to face relevant limitations in their possibilities to invest in China, in particular in key sectors with high growth rates. The CAI favours greater reciprocity while maintaining the safety and quality standards applied by the EU in both industrial processes and outputs.

➡️ Researchers at Bruegel have developed a blueprint for green industrial policy in the EU (I will come back on this topic next week with some other contributions).

➡️ Horizon 2020 is ended and Nature has an interesting article on how the €60 billion budget was distributed among European countries.

➡️ In the US, governmental agencies are under investigation for potential ties between funded researchers and China (Science).

Technology

Space tech

In partnership with Kyoto University, the logging company Sumitomo Forestry is developing a wooden satellite to be launched by 2023 (BBC). The goal is to reduce space junk as those satellites “would burn up without releasing harmful substances into the atmosphere or raining debris on the ground when they plunge back to Earth”. The sustainability of space operations is a growing concern as space launches hit a historical record in 2020 (see Reshaped #46 for more on that) and there is the chance to see major improvements in this field in the years to come.

Meanwhile, the futuristic goal of generating solar power directly from space and sending it to Earth through wireless technology continues to attract investments. Recently, the Air Force Research Laboratory announced it has received the first hardware component of its Arachne spacecraft, an experiment within the Space Solar Power Incremental Demonstrations and Research (SSPIDR) project (CleanTechnica). Such technology would have enormous advantages for energy production (BBC).

Renewable energy technologies have developed drastically in recent years, with improved efficiency and lower cost. But one major barrier to their uptake is the fact that they don’t provide a constant supply of energy. […] A possible way around this would be to generate solar energy in space. There are many advantages to this. A space-based solar power station could orbit to face the Sun 24 hours a day. The Earth’s atmosphere also absorbs and reflects some of the Sun’s light, so solar cells above the atmosphere will receive more sunlight and produce more energy.

➡️ Space missions to the Moon in the 1960s generated concerns about potential “back contaminations”, that is the risk of introducing alien microbes on Earth (Aeon).

Big Tech

Amazon announced the acquisition of the podcast publisher Wondery, which will join Amazon Music’s new podcasting services. The deal is an attempt by Amazon to fill the gap with early entrants in the podcast market (like Apple and Spotify), which is becoming more and more concentrated — see this piece by Matt Stoller on the risks of this kind of concentration. However, as argued by Matthew Ball, the audio opportunity is too big to be missed as “the reallocation of revenue and time will fund an enormous set of new content creators, production companies, and distributors” (see chart below).

Meanwhile, in the world of tech corporations:

The activist hedge fund Third Point LLC, led by Daniel Loeb, is pushing Intel to implement radical strategies to overcome the current crisis, including a potential separation of chip design and manufacturing processes into different companies (Reuters). The recent losses in human capital (talented workers leaving the company) are particularly worrying and active investors can play a pivotal role in overcoming the deadlock.

Tesla signed a 5-year deal with the Chinese company Sichuan Yahua for the supply of battery-grade lithium hydroxide (Reuters). Notice that due to the extreme volatility in lithium prices (see Reshaped #41) Tesla has an interest in stabilizing supply levels by making demand more stable and easier to forecast. The (absurd) alternative would be a risky vertical integration strategy, which is made almost impossible by lithium geography.

The Hyundai-controlled Boston Dynamics released a video of four of its robots dancing (The Next Web). Quite impressive.

➡️ The New York Times’ Kevin Roose announced the 2020 Good Tech Awards (with some interesting startups you will like).

➡️ Chemistry World published a 2020 roundup of chemical and pharmaceutical industries. Highly recommended reads.

Finance

Venture capital

It is too early to know if the fourth quarter of 2020 will stick to the recent positive VC trend to surpass last year’s Q4 (see chart below). Overall, the pandemic seems to have impacted the number of VC investments more than their total value. This resilience is positive news for the industry, which is still facing some criticism for its inequality in both teams composition and portfolio selection. Despite the powerful racial protests in the US and abroad, VC-backed black founders still represent about 1% of the total, while the trend for female entrepreneurs could have been even worse than in 2019 (Wired). In addition to this challenge, in 2021 global VCs will have to prove that they can sponsor radical technological transformation in high-risk, capital-intensive sectors like cleantech and deep tech, where their historical performance is seesawing.

➡️ On Real Life, Adam Willems investigates the origins and the consequences of startup cults, which tend to hide their more ordinary profit-seeking nature.

ESG investing

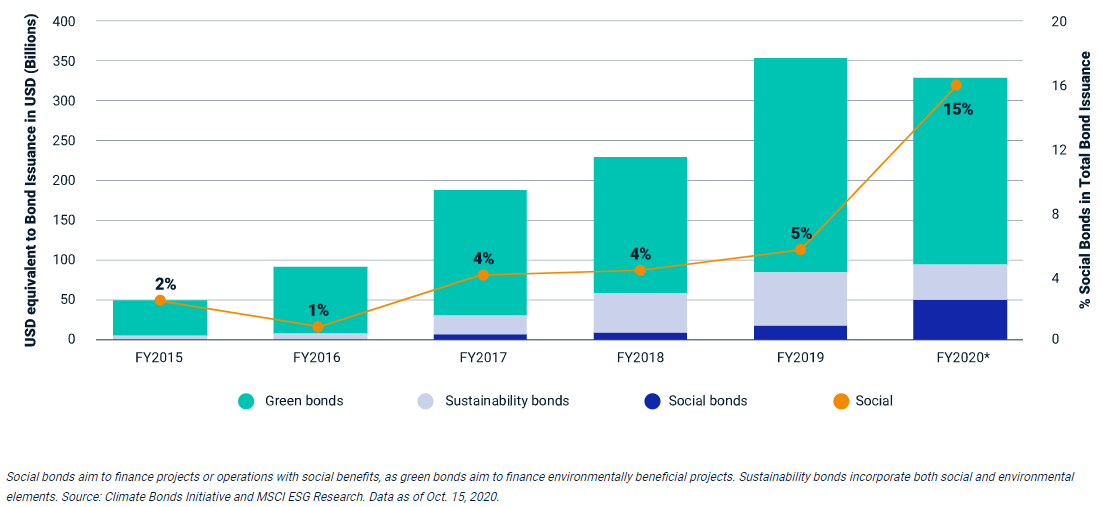

The incredible year for ESG investments (see chart below) is set to determine much of the direction of global investments in the years to come.

A recent MSCI report highlights five trends to watch in 2021:

After having started to align portfolios to meet the Paris climate goals, investors will have to face a difficult second phase, that is to convince corporate Boards to implement radical changes in their operations.

Improved clarity on when and how ESG investing generates real benefits.

A greater focus on biodiversity.

Stricter disclosure rules for companies and investors.

Strong growth of social bonds (see chart below) as part of “more creative, systemic approaches to reducing inequalities”.

The big picture

I might have a problem with people — biased like you and me by a wide range of factors — pretending to have any authority to make big predictions about the future of humankind. (I dedicated some space to a critique of New Optimism in Reshaped #41.) This is not limited to (self-styled) futurists and includes also scientists and historians. The most renown example is Peter Turchin, according to whom “we must transform history into an analytical, predictive science” (see this old article on Nature for a manifesto of cliodynamics, the discipline he founded). Basically, he relies on mathematical models to explain how the world will evolve — which, by the way, is incomparably more interesting than any futurist’s new book about the world in the next decade or so.

In a recent interview on The Atlantic, Turchin explains the reasons for his dark view of the future.

The fundamental problems, he says, are a dark triad of social maladies: a bloated elite class, with too few elite jobs to go around; declining living standards among the general population; and a government that can’t cover its financial positions. […] “We are almost guaranteed” five hellish years, Turchin predicts, and likely a decade or more. […] Of the three factors driving social violence, Turchin stresses most heavily “elite overproduction”—the tendency of a society’s ruling classes to grow faster than the number of positions for their members to fill. One way for a ruling class to grow is biologically—think of Saudi Arabia, where princes and princesses are born faster than royal roles can be created for them. In the United States, elites overproduce themselves through economic and educational upward mobility: More and more people get rich, and more and more get educated. Neither of these sounds bad on its own. Don’t we want everyone to be rich and educated? The problems begin when money and Harvard degrees become like royal titles in Saudi Arabia. If lots of people have them, but only some have real power, the ones who don’t have power eventually turn on the ones who do.

The symptoms Turchin highlights are truly worrying and are part of a global debate among historians, scientists of many kinds and economists. The problem arises when some of these scholars and politicians pretend to derive accurate predictions of the future with their apparently faultless cause-and-effect relationship models. The same applies to the wide range of optimistic responses to Turchin’s opinions that were recently published. I will take as an example of this form of New Optimism Tony Morley’s piece on Quillette, which says that in spite of the pandemic “progress hasn’t contracted nearly as sharply as we might assume, and that is cause for celebration”.

Personally, I would love to see more analysis and less prediction; more action to face global challenges and fewer attempts to sweeten the pill. To do so, we already have to fight old narratives that make it difficult to enable radical change in our society. Adding new ones is a risky bet that will probably not help.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico