🌌 Reshaped #41

The big IPO wave, Amazon into healthcare, metals price volatility, space VCs, New Optimism and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

I am working on a couple of side projects at the moment — one of them being the already mentioned dive into the three-player game that is under development around climate technologies — so this edition is a bit shorter than usual. For more on European startups and VCs, take a look at the new weekly newsletter by our friends at The Dart!

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

The state

Tech policy

Last Sunday, fifteen Asia-Pacific countries signed the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free-trade agreement (BBC). The RCEP is often seen as a China-centric deal that will further reinforce the Chinese dominance in the Pacific region. However, according to Christian Le Miere, this is a simplistic view: more than a Sinocentric deal, the RCEP showed that Asian countries can pursue their interest without the involvement of the US (South China Morning Post).

This would have probably been unimaginable until a few years ago. The unknown outcomes of the trade war between the US and China force other countries to rebalance their trade agreements to mitigate risks. For sure, China is achieving a substantial dominance in technology that is certified by the development of successful consumer applications that are adopted and replicated worldwide. In a recent article on BBC Future Inc, Chris Stokel-Walker explains how Chinese social media apps are reshaping the technological landscape to the detriment of the US-centric Silicon Valley model.

If Chinese companies continue to play an increasingly influential role in tech, our online world could look very different by, say, 2030. For one, it could be much more diversified than the Silicon Valley standard we still, largely, see now. And while Chinese apps are best-known right now, that could change. […] We might also see apps having an increased emphasis on localisation, something we already see with TikTok. […] And we may see Western products taking more of a lead from successful strategies or services out of China, and the rest of Asia.

Meanwhile, in the US, Silicon Valley elites are pressing Joe Biden to get a seat in the upcoming administration (Recode). I have briefly written about the ambiguity of Biden’s approach to tech corporations in the last issue. Apart from the risk of dividing the Democratic base, the inclusion of tech barons like Eric Schmidt in Biden’s staff could be a conservative move that slows down the renewal of the American national innovation system.

➡️ In the UK, Boris Johnson is facing growing pressures to implement a more ambitious national strategy to cut greenhouse emissions (The Guardian).

Regulation

There are three main things to know about tech regulation this week:

Jack Dorsey (Twitter) and Mark Zuckerberg (Facebook) testified again in front of the Senate Judiciary Committee about platform regulation and misinformation (The New York Times). Among the many issues that tech regulation has to cope with, content moderation is one of the hardest. In my perspective, these hearings can do little to solve any problem.

In the EU, the Internal Market Commissioner Thierry Breton announced stricter rules for tech corporations as part of the new Digital Services Act and the Digital Markets Act, which will be released on December 2 (Reuters).

Apple, which recently announced a cut in App Store commissions (from 30% to 15%) for apps generating less than $1 million on its platform (CNBC), was accused by the Austrian privacy activist Max Schrems of tracking iPhone users for advertising purposes with no direct consent (Financial Times).

➡️ Fighting Big Tech is now enough: Europe needs to build its own digital economy to succeed in the XXI century (Financial Times).

➡️ Both in the EU (Chemistry World) and in the US (Science) there are growing concerns about the regulation of gene-edited crops.

The markets

Healthcare

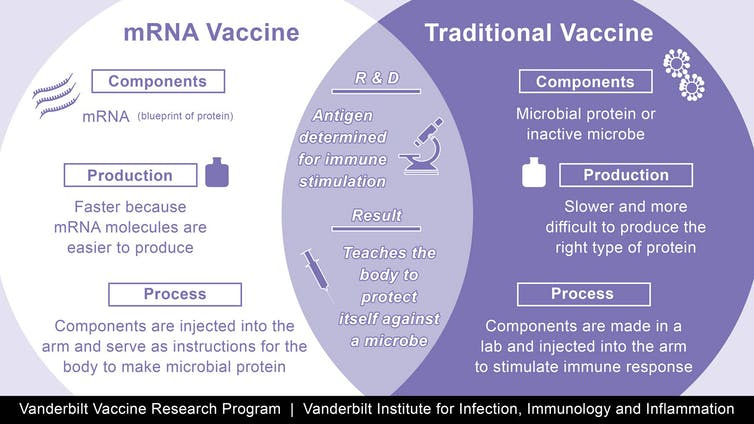

Pfizer and Moderna’s announcements of their progress in researching and testing COVID-19 vaccines rapidly generated diffused optimism among investors and business leaders. To some extent, this obscured the breakthrough innovation that stands behind these results: the use of mRNA. On The Conversation, Sanjay Mishra explains that “rather than having the viral protein injected, a person receives genetic material – mRNA – that encodes the viral protein” so that “the human body uses the instructions to manufacture viral proteins itself” (see picture below). However, mRNA vaccines are more difficult to manage and require extremely cold temperatures.

Meanwhile, Amazon is entering the US healthcare market with a new service called Amazon Pharmacy, which will allow users — with or without insurance — to purchase a wide range of drugs (The Verge). The launch of Amazon Pharmacy follows the acquisition of the pharmaceutical delivery startup PillPack back in 2018 and is totally consistent with the goal of exploiting any opportunity derived from its competitive advantage in logistics. Price savings for Prime members are huge and could pave the way for Amazon for radical disruption of the domestic healthcare industry (The Wall Street Journal).

European startups

A few weeks after the takeover of Sia, the Italian payments technology firm Nexi has agreed to acquire the Danish competitor Nets (Reuters). The all-stock deal is worth about €7.8 billion and will transform Nexi into a European giant for payment technologies worth €22 billion. According to the Financial Times (see picture below), private equity firms managed to succeed where banks did not by taking control of digital payments companies before their rise in relevance in the digital age.

A new report by McKinsey explores the European startup ecosystem and its most recent trends. With respect to the Dealroom & Sifted analysis I shared with you in a recent issue, this report adds a very interesting variable to explain the differences between the EU and the US in terms of startup development: the source of VC funds (see picture below). This is extremely important: government and corporate investors tend to have different goals than large pension funds and behave more as strategic investors. This way, exits through acquisition are favored in earlier stages and restrain the development of other-than-seed capital.

➡️ An MIT study reveals that, in the US, “universities contributed far more to the ‘Algorithmic Commons’ than private companies” (The Next Web).

➡️ Take a look at the best inventions of the year according to Time!

Technology metals

According to Nature, the supply of the metals required to produce solar panels, wind turbines, and batteries is at risk — which might have negative consequences on the path towards a more sustainable energy mix.

The pandemic has partly or wholly closed hundreds of mines, smelters and refineries. Metals production will be at least one-third lower this year than last, with an estimated potential loss worldwide of almost US$9 billion in revenue. […] Industrial demand for metals has fallen in the global slowdown. Factory and border closures have disrupted international supply chains, too.

The trends in price volatility (see charts below) are very interesting as they show a drop in the first months of the pandemic and a steady recovery after the end of the Wuhan lockdown. On the other hand, lithium prices — a key metal for battery production — have never recovered from the drop. Gallium and indium, used for chip manufacturing, had a spike in prices at the end of the summer due to a lower offer and a reduction in stocks. In the long run, this might force chip manufacturers to adapt their pricing structure consequently.

The authors suggest three mitigation strategies: the exploitation of other reserves to make supply chains less dependent on China (even if it takes time and carries a relevant environmental cost); the use of alternative materials; and the improvement of recycling processes (“worldwide only 17% of electronic waste is collected and treated”).

➡️ There are some interesting reasons behind Apple’s choice not to make a touchscreen Mac (Digital Trends).

The speculators

IPOs

The IPO window remains open for tech startups in many sectors. The most interesting announcements of this week include the following:

The trading startup Robinhood, which has a private valuation of $11.7 billion, is considering an IPO in the first quarter of 2021 (Bloomberg).

Roblox, a widely popular user-generated game platform with a growing user base, disclosed its filing to go public early next year (VentureBeat).

Affirm, a fintech startup with growing revenues and a peculiar customer base, filed to go public despite having generated no profits to date (TechCrunch).

DataRobot, a startup specialized in machine learning automation, raised a Series F round worth $270 million at a $2.7 valuation, planning to go public soon after the deal (SiliconAngle).

The AI startup C3.ai, founded in 2009 by Tom Siebel (who invented the first CRM system) and valued at $3.3 billion, filed to go public last week (CNBC). This company is my favorite example of a perfectly executed pivot from energy-specific to generalist AI suite.

The shopping app Wish is planning to go public in the US (Reuters).

However, investors are especially focused on Airbnb, which filed for its long-awaited IPO this week. The IPO “could value Airbnb at more than $30 billion and raise as much as $3 billion” despite a drop in revenues and more-than-doubled net losses due to the pandemic (The New York Times). While many of the companies mentioned above — and DoorDash, which filed its S-1 last week — benefited from the pandemic, Airbnb was shocked by it. To know more about its potential growth path, take a look at this excellent analysis by Byrne Hobart.

➡️ Tesla will be added to the S&P 500 in December, which could boost its shares even more (The Wall Street Journal).

➡️ Differently from what happened in past recessions, job recovery is slower for the lowest-earning industries than the highest-earning ones (Axios).

➡️ Is value investing still relevant in the intangible economy, apart from the recent rotation in growth vs. value stocks? An excellent long read by The Economist.

Venture capital

The space economy continues to attract investors of all kinds. Relativity Space, a startup that aims at making rockets production faster and more efficient thanks to additive manufacturing, is raising $500 million at a $2.3 billion valuation in a new round led by Tiger that will include also Fidelity and existing investors (CNBC). According to TechCrunch, the financing round is aimed “to scale operations in earnest, gathering the personnel, materials, transportation, insurance and other necessaries for taking on major missions”.

It is not surprising that so many investors are pouring money into Relativity Space. It is already one of the most valuable space startups, with an excellent R&D execution path and good relationships with space agencies. Its Terran 1 rocket is less reliant on basic components than major competitors do and will require only 60 days to be built, taking advantage of 3D printing for roughly 95% of its parts. In the mid-term, the cost advantage could be huge enough to impact the manufacturing process of the entire space sector.

➡️ I owe to Rodolfo Rosini the discovery of this wonderful NASA design study on space settlements. It dates back to 1977 and is simply extraordinary.

➡️ Rocket Lab tested its recovery parachute system, which could make rockets more sustainable (Engadget).

➡️ What if we could generate energy through solar power stations? Apparently, the ESA is working on that (The Conversation).

The big picture

On Palladium, David Salisbury argues that we need to go beyond what he calls “New Optimism” — an ideology of progress I have always found extremely biased and naïve — to take into account “our exposure to catastrophic risk”. Very recommended read.

According to New Optimists, the trajectory in each of these spheres [health, freedom, and education attainment] is undeniably positive, pointing to a gradual improvement in the human condition. […] By obsessively focusing on observed outcomes, New Optimism ignores the distribution of potential outcomes that could have arisen, had history unfolded in a conceivably different direction. […] This places humanity in a precarious position: while our material well-being has generally improved, it has come at the cost of us bearing an unprecedented degree of risk that, in the extreme, threatens to unravel the entire human endeavor.

Above all, New Optimism is biased because it reads data with a cultural mediation derived from ideology. For instance, we might be prone to thinking that the rapid diffusion of democracies in the XX century is per se a positive phenomenon. This, however, fails to recognize the qualitative aspects of democracy, that determine its adherence with the original meaning. On Books & Ideas, Timothy Kuhner explains how modern democracies continue to be conditioned on property ownership as far as governments remain subservient to capital.

Where private property has accumulated in the hands of the few and been permitted to exercise undue influence over political systems, greed determines the course of economics, politics, and even the climate. Such greed is neither accidental nor inevitable, but the result of widespread and systematic vulnerabilities in the democratic form. Despite universal suffrage, the aristocracy of wealth has been permitted to dominate humanity. […] The many nations of the world will either rescind the Oligarchs’ Charter—and produce real democracy—or send the liberal order and the natural world to their graves.

➡️ According to a new study, there is a relationship between the unemployment rate and income distribution.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico