🌌 Reshaped #54

A British DARPA, the EV mass production challenge and the quest for a more ambitious Social Cost of Carbon

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time.

After one year, I decided to switch from a weekly format to a new one without a defined schedule. Today, I am testing a new structure, in which I cover three topics that caught my eye recently. Let me know what you think!

🎙 You can still listen to The DART Bullseye on Spotify, Google Podcasts or Apple Podcasts. This week, I had an interesting chat with Enrico Costanzo, Innovation Manager in the biotech sector.

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

Some updates…

On Innovation Policy

The UK government recently announced the launch of the Advanced Research & Invention Agency (ARIA), an independent research agency with an £800 million budget that “will be led by scientists who will have the freedom to identify and fund transformational science and technology at speed”. The main goal is to remove the dangerous bureaucracy that hampers innovation — even if the agency, which is a late implementation of the 2019 Conservative manifesto, will not be fully operational until 2022 (Financial Times).

Moreover, the “funding models including program grants, seed grants, and prize incentives” seems to be very similar to its EU counterpart, which is often considered not sufficiently advanced to promote technological innovation. The opposition Labour Party claimed that the government needs to provide more details on the goals and the activities of the agency to avoid a mere branding effort (CNBC). For sure, at least two issues should be clarified: its relationship with the existing university research network and the ownership models for funded projects.

These issues are not optional. ARIA is explicitly inspired by the US Defense Advanced Research Projects Agency (DARPA)1, founded in 1958 to fill the gap with the Soviet Union in developing military technology. However, as explained by Mariana Mazzucato2, DARPA’s range of activities was not limited to funding R&D projects.

The role of the State in the Defense Advanced Research Projects Agency (DARPA) model goes far beyond simply funding basic science. It is about targeting resources in specific areas and directions; it is about opening new windows of opportunities; brokering the interactions between public and private agents involved in technological development, including those between private and public venture capital; and facilitating commercialization.

Nonetheless, apart from doubts or criticism, ARIA could be a fundamental step for the UK to overcome its innovation problems. As highlighted by Martin Wolf in the Financial Times, the slow productivity growth of the country during the last decade is paired with a relatively low R&D expenditure as a percentage of GDP (see chart below). If productivity is correlated to the “capacity to develop new things” more than “doing more of the same thing”, then R&D is key to avoid stagnation.

Wolf’s focus on capabilities is particularly interesting, as it outlines a potential win-win scenario for agencies like ARIA. Indeed, rewards for society can come from successful R&D in terms of new technologies and capabilities or, in the worst-case scenario, from unsuccessful R&D in terms of capabilities to apply elsewhere.

The economic rationale for supporting innovation is that knowledge is a semi-public good. This is not just a theoretical point. In practice, government support has played a central role in developing almost all of the fundamental technologies of the 20th and 21st centuries. But governments play a central role [in developing capabilities] because almost any significant new capability has public goods aspects. To take one example, the knowledge a business develops will be embedded in people who may leave to work for a rival business.

On Electric Vehicles

The EV industry is one of the most vivid examples of how the mechanisms of the innovation economy work:

On the policy side, governments all around the world are promoting EVs as part of their climate strategies (see, for instance, Joe Biden’s EV plans or the EU commitments to subsidize battery production). This sets positive expectations for private actors3.

Technology advancements coincide with more reactive cost curves and efficient operational models. This applies not only to Tesla’s sales record in 2020 (almost half a million deliveries) but also to adjacent markets such as lithium batteries. For instance, Quantumscape CEO Jagdeep Singh recently announced that the US-based startup has overcome some of its major hurdles4 for manufacturing solid-state lithium-metal batteries, which could make mass production easier to achieve5 within the current decade (Bloomberg).

Finally, markets react with the typical frenzy that periodically leads to wide or industry-specific technological bubbles. In this case, we might say that EVs are in a bubble inside the broader tech bubble. In the former, particular forms of speculation take place, like the many SPAC acquisitions of EV startups with no revenues. Recently, Lucid Motors set an industry record with a $24 billion valuation when it was acquired by a blank-check company (TechCrunch).

Consequently, traditional players in the car industry — like GM, Ford and Volkswagen — have announced ambitious plans to go carbon neutral and improve their EV offer. This will rapidly increase the demand for batteries, which is going to have significant geopolitical consequences (The New York Times).

Most experts are certain that demand for batteries will empower China, which refines most of the metals used in batteries and produces more than 70 percent of all battery cells. And China’s grip on battery production will slip only marginally during the next decade despite ambitious plans to expand production in Europe and the United States […].

Besides, the relevance of Chinese FDI in countries like Congo would further amplify this effect (see picture below).

On the Social Cost of Carbon

Last January, with an executive order, Joe Biden established the Interagency Working Group on the Social Cost of Greenhouse Gases, which is primarily tasked with publishing a final Social Cost of Carbon (SCC), Nitrous Oxide (SCN) and Methane (SCM) no later than January 2022. The SCC6 is temporarily set at about $52 per ton — the nominal value it had during the Obama administration before Trump decreased it to $8 per ton (Inside Climate News). However, in a recent paper, economists Nicholas Stern and Joseph E. Stiglitz claim that this value is not enough to drive any relevant change7. Surprisingly, their recommended price (about $100 per ton by 2030) is lower than what most economists have proposed8 in the last couple of years!

Unfortunately, this kind of confusion is not new to climate economics and policy. For instance, among the recommendations that a group of scholars published on Nature, there is a due update of the discount rate used for environmental cost-benefit analysis and the separate treatment of different industries. And, I would add, it is fundamental to clarify the role of market instruments — either carbon taxes and cap-and-trade programs — in the broader policy mix: up to now, their role has mostly been limited to sectors with well-defined technology standards (such as energy) on top of stricter regulations9. In addition, the cost of pollution entails hard moral choices about the value of future generations (see The big picture in Reshaped #53).

For the various actors emerging in the new cleantech wave, an updated (and stable) SCC would be a very valuable asset. Differently from domestic forms of regulation and carbon taxes, which are often state-specific, such a metric10 could be applied with small variance across similar countries. This would set clearer expectations regarding any policy or business strategy to be implemented in the medium term. For startups working in emerging fields such as carbon capture and storage or battery production, an updated SCC aligned with technological cost curves would drastically simplify demand forecasts. To some extent, the social cost of carbon would be “the most important number” not only to fight climate change but also to reduce uncertainty in the cleantech sector.

Other gems

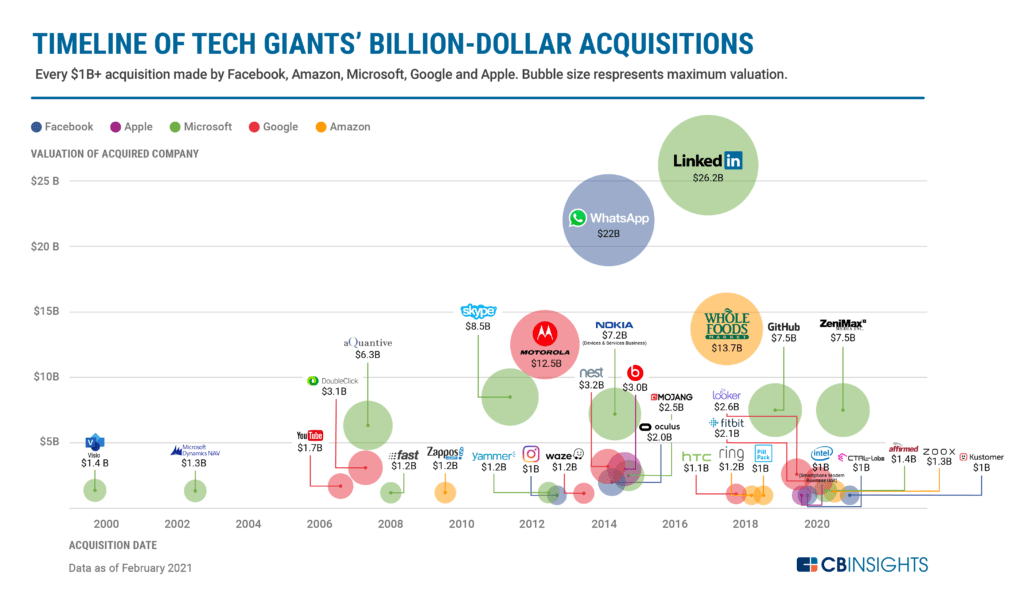

Tech acquisitions. CB Insights recently updated its renowned infographic on Big Tech M&As (see picture below). 2020 saw a decline in these investments due to fears of antitrust scrutiny; yet, there are some stable, common patterns year over year (look at Microsoft!).

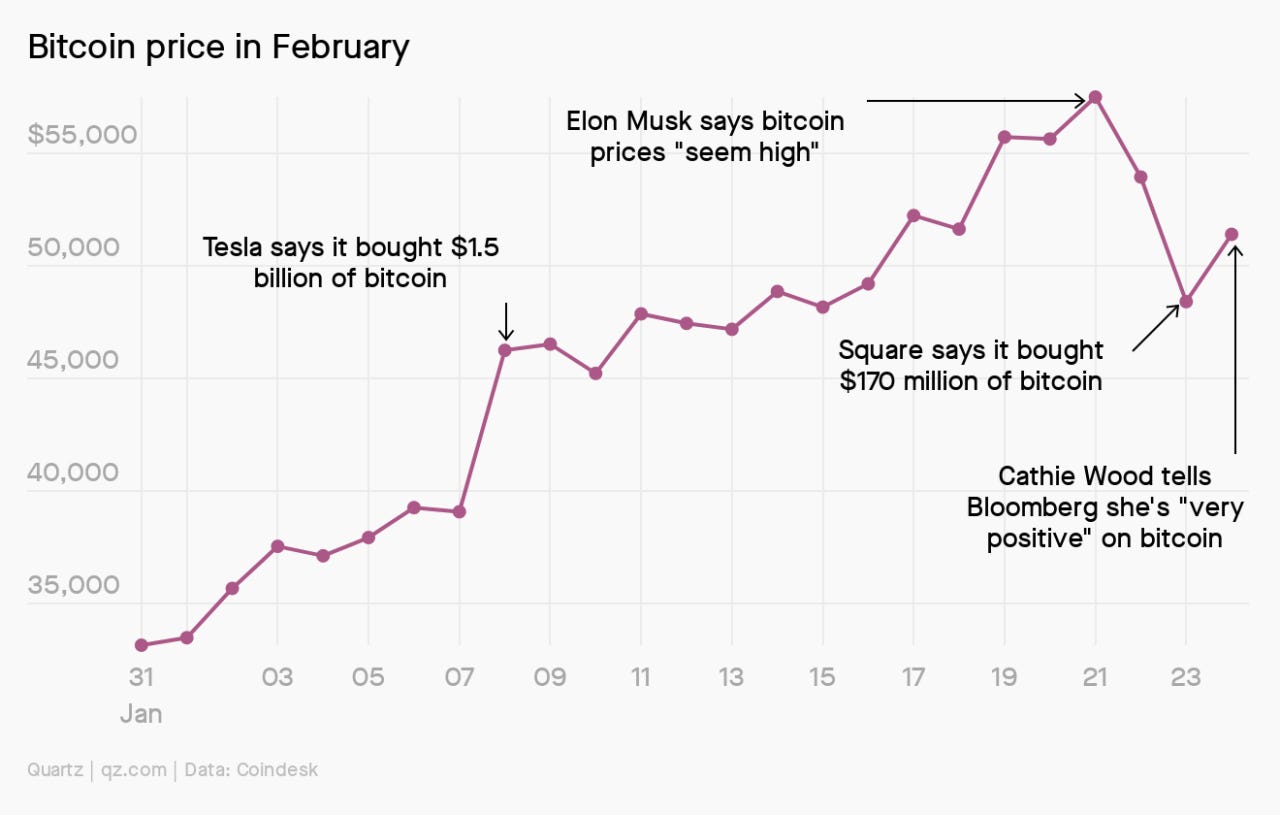

Bitcoin value. The debate regarding the value of Bitcoin continues to hold (see J. Christopher Giancarlo in the Financial Times). On Quartz, John Detrixhe correctly points out that this value seems to be close to “whatever influential people like Elon Musk and star stock picker Cathie Wood say it is” (see picture below).

Breakthrough technologies. MIT Technology Review editors published a list of the ten breakthrough technologies of 2021. I was positively surprised to see Data Trusts featured in this list. Defined as “a legal entity that collects and manages people’s personal data on their behalf”, the Data Trust has the potential to reshape the way we organize data in many sectors, starting from government and public services.

Thanks for reading.

Now more than usual, I would appreciate your feedback on the new structure and type of content. If you enjoyed reading this issue, please leave a like (heart button above) and share Reshaped with potentially interested people.

As ever,

Federico

There are two accessible books I would recommend to readers willing to know more about DARPA: Annie Jacobsen’s The Pentagon's Brain: An Uncensored History of DARPA, America's Top-Secret Military Research Agency and Sharon Weinberger’s The Imagineers of War: The Untold Story of DARPA, the Pentagon Agency That Changed the World. Both provide a historical perspective on the agency and its long-term impact on the American economy.

Mariana Mazzucato, The Entrepreneurial State: Debunking Public vs. Private Sector Myths.

Even if, as argued by Andy Palmer — who pioneered EV research and development at Nissan — in a recent column on the Financial Times, governments have to “encourage a competitive environment that sees engineers battle it out to discover and develop multiple technologies to reach that goal”, because “electric vehicles may not be the best way”.

See Steve LeVine’s analysis on The Mobilist for more on that.

“The first priority for the industry is to make batteries cheaper. Batteries for a midsize electric car cost about $15,000, or roughly double the price they need to be for electric cars to achieve mass acceptance […]” (The New York Times).

Defined by the OECD as “the net present value of climate change impacts over the next 100 years (or longer) of one additional tonne of carbon emitted to the atmosphere today. It is the marginal global damage costs of carbon emissions”.

See this article on Project Syndicate for a summary of their proposal.

See this Twitter thread by Gernot Wagner.

This means that, out of the total environmental benefit expected, governmental or local regulations do the first and biggest part of the job. CAT programs are activated on top of an already regulated market, which limits their potential and distorts results.

Notice that this process is similar to the near-term to net zero (NT2NZ) approach proposed months ago on Nature Climate Change.