🌌 Reshaped #43

DeepMind's Alphafold 2, European asymmetric regulation, open-source fintech, transformative innovation policy and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

I received positive feedback about last week’s dive into how biotech investing might be transformed by mRNA, which means I will come back to this topic in the future with the help of sector-specific VCs. Reach out to me if you have any contributions!

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

The state

Digital taxes

Indonesia could follow France in collecting a digital tax despite the lack of a multilateral agreement within the OECD (Reuters). Indonesia has already started to collect a 10% VAT on digital products and services, which could serve as a baseline to calculate the income generated by tech corporations in the country. Canada is ready to apply similar measures as well, starting from the application of its goods and services tax (GST) or its harmonized sales tax (HST) to digital services (CBC). In other words, at the moment consumers of these services will pay the tax; subsequently, an income tax could be applied for corporations.

However, the application of taxes on internet companies continues to raise concerns about the relationship between the US and the EU (Politico). Trump will probably retaliate against France by imposing tariffs on French goods and it is still unclear how this could change under Biden’s presidency (Axios).

➡️ Facebook is going to pay UK digital media to license their articles (The Guardian).

Regulation

According to the Financial Times, which had the chance to see an early summary of the upcoming European Digital Services Act, the EU is going to implement two-tier, asymmetric regulation for digital platforms operating in the continent. In other words, the largest companies will be subject to stricter rules than smaller ones, which is supposed to favor competitiveness and allow new entrants to effectively challenge incumbents. Asymmetric regulation is one of the most common forms of industrial regulation as it aims at balancing market asymmetries arising from monopolies with specular policy instruments.

It has been widely applied in traditional industries like energy and transportation for decades, but it could have particularly positive effects in the digital sector, where market instruments like digital taxes could simply translate into more pressure on Big Tech margins. On the other hand, regulators should avoid the creation of a “Small Tech” tier that is exempt from the big regulatory challenges of our time — from privacy to misinformation and data extraction. If we want these principles to stay at the core of new digital business models, it is fundamental that new entrants play the digital game with fair weapons.

➡️ The Trump administration is going to add SMIC, China’s largest chipmaker, and CNOOC, an oil and gas producer, to its blacklist of Chinese companies excluded from the supply of key US technologies (Bloomberg).

➡️ Singapore is the first country in the world to give regulatory approval to lab-grown meat (BBC).

The markets

Artificial intelligence

An AI network developed by DeepMind, the London-based AI research company acquired by Alphabet in 2014, outperformed rival teams in the CASP14 challenge, solving the 50-years old “protein folding problem” (The New York Times). Basically, the AlphaFold 2 computer system can determine a protein’s shape from its amino-acid sequence — a process that can take years of experiments to deliver results — much faster than ever before, which could be extremely beneficial for scientific research.

DeepMind’s results raise two fundamental questions:

How much the AI network will impact medical research, drastically accelerating drug discovery? Researchers could process lower quantities of data and achieve much more precise results, which would shorten R&D cycles and cut costs. There would be an impact also on biotech investing, similarly to what I wrote last week.

Should we become more optimistic about Artificial General Intelligence (AGI)?

For a deep dive into this breakthrough discovery, see the excellent analysis by Lex Fridman (video below) and Ewen Callaway’s piece on Nature.

➡️ Artificial General Intelligence is the myth that sustains the current AI boom, but we are still very far from reaching the goal (Scientific American).

➡️ State researchers in China announced the development of a quantum computer that is “10 billion times faster than Google’s ‘Sycamore’ machine” (The Next Web).

M&As

Salesforce finalized the acquisition of Slack in a cash-and-stock megadeal worth $27.7 billion, paying a 50% premium with respect to the share price of the latter before the deal was announced (The Wall Street Journal). This is an enormous amount of money for a company that not only is still unprofitable but also had a disappointing growth pattern during the pandemic, which has benefited rivals such as Microsoft and Zoom. The bet for Salesforce is about Slack becoming “that glue that holds the Salesforce ecosystem together”, but this will require outstanding execution in merging two very different actors of the digital economy (TechCrunch).

On The Verge, Casey Newton claims that this acquisition is a tangible sign of how Microsoft (the late entrant in the sector) won the battle against Slack in scaling up professional communication applications. The consolidation of the industry leaves little choice for individuals in choosing their tools.

But it also feels like the end of an era, one where workers gained new power to bring their own tools to the office and decide for themselves how they wanted to get work done. Slack first succeeded with small teams who wanted to accelerate their work and was often dragged into organizations by early adoption. But today, waves of consolidation are leaving people with fewer real choices.

Meanwhile, Facebook announced the acquisition of Kustomer, a CRM startup that will expand the range of B2B services for an improved flow from managing ads to closing sales (CNBC). The deal is worth $1 billion and is a rare example of Facebook buying business-oriented software.

➡️ Stripe, in partnership with banks like Goldman Sachs and Citigroup, will offer business banking services to its customers (The Wall Street Journal).

➡️ Amazon is expanding the use of its Arm-designed, homegrown chips to replace Intel’s, a sign that “key decisions in chips may increasingly shift from silicon suppliers, where the power had long resided, to chip users with the resources to make their own components” (The New York Times).

The speculators

Venture capital

Moov, a fintech startup that provides open-source and modular technologies that allow digital platforms and marketplaces to add payment options into their software, raised a Series A round worth $27 million, which follows the $5.5 million seed round raised in August. The open-source nature of Moov’s architecture — a developer-first approach that echoes Stripe — can generate new business models in fintech that shift revenue generation from the architecture to the whole set of services that can be delivered on top of it — from customization to maintenance.

This is another sign of the growing importance of services to generate revenues with the gradual standardization of fintech architectures, as perfectly described by Ian Kar some months ago.

Infrastructure is a cutthroat area of fintech—there could be incumbents that already provide something similar, but you do it with better tech or a cheaper price. Competition implies that margins will get compressed over time—if you’re not undercutting someone on price, then someone’s eventually going to undercut you. For younger fintech companies in the space, this is a pressing concern. And I think there’s a playbook for companies—expand into value added services. […] I think infrastructure companies are going to start exploring this more, and also services that aren’t driven by technology.

➡️ A new study by the Harvard Business School shows that the pandemic is having a less negative impact on VC investments than private equity as a whole.

Impact investing

Corporate disclosures about the ambition to fight climate change through net-zero commitments are rapidly spreading among sectors of all kinds. However, there is still a gap between commitments and an authentic willingness to invest in the reduction of carbon emissions (Financial Times). This is having negative consequences on how wealth funds allocate capital to invest in the most virtuous companies. In particular, their skepticism is related to the inconsistent and vague objectives set by traditional industries like oil & gas and retail.

The ambiguity of many of these net-zero announcements forces investors to adapt their portfolio strategies to finance large emitters with realistic climate plans instead of “loudest committers” with a few chances to reach their net-zero ambitions. For instance, even a small reduction in the emissions of Nestlé — which has recently announced new commitments towards regenerative agriculture — could have a much more significant impact on climate change than more ambitious plans launched by smaller companies.

➡️ A new report by McKinsey explores how Europe could go carbon neutral at net-zero cost.

➡️ A new UNEP report highlights the inconsistency within state-level climate policy as “governments continue to plan to produce coal, oil, and gas far in excess of the levels consistent with the Paris Agreement temperature limits”.

➡️ Depending on the shape of the learning curves, hydrogen could be either an energy revolution or another failure (Bloomberg).

The big picture

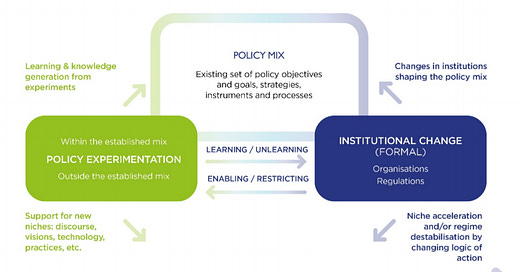

A new SPRU working paper explores how transformative innovation policy (TIP) can accelerate the adoption of sustainable innovations — with a very interesting study about the development of mobility-as-a-service (MaaS) in Finland. In particular, the paper explores how policy experimentation and institutional change influence policy mixes by providing knowledge and enabling new governance structures (see picture below).

The paper is very interesting for those working at the intersection between public policy and technological deployment as it provides two key learnings:

First, “policy experimentation is more likely to lead to substantial changes in the policy mix when there is political backing and support to use the learning from experimentation to form new policies”.

Second, “policy experiments’ broader influence and formal institutional change are more likely when the socio-technical system is already changing, and when incumbent actors have begun to question their assumptions, beliefs and values and being more explorative about how to address a global ‘wicked’ problem”.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico