🌌 Reshaped #25

SPACs for speculation, Big Tech hearings and financial results, Huawei smartphone dominance, new unicorns and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

This was a strange week, as Big Tech got all the attention for their Q2 results and, in particular, the congressional hearings on antitrust. I will dedicate more space to that topic in future issues, when we will know more about how the situation will evolve into practical terms. In the opening essay, I tried to explain the relationship between the growth of Special Purpose Acquisition Companies (SPACs) and VC speculation. I am curious to know your opinion on that.

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

SPACs and VC speculation

Recently, Special Purpose Acquisition Companies (SPACs) gained some unexpected momentum. Ribbit Capital, a VC focused on fintech startups, is planning to launch a $600 million SPAC soon. Even sports ventures got involved, with former baseball player Billy Beane ready to embark in a similar effort.

As defined by Harvard University, SPACs “are companies formed to raise capital in an initial public offering (IPO) with the purpose of using the proceeds to acquire one or more unspecified businesses or assets to be identified after the IPO”. Basically, while an IPO is built around a private company willing to go public, a SPAC consists of a public company with no other aim than merging with a private company after an accurate selection process.

The typical process of SPAC creation can be summarized as follows. First, someone raises money from investors to go public, committing to finding an interesting business to merge with (thus making it public) within two years. After the merger, SPAC investors will automatically become shareholders in the new company at a pre-determined price. If they disagree on the target company, investors can get their money back; the same applies if, after two years from the SPAC IPO, no merger or acquisition is done. A SPAC’s founder gets 20% of the total shares of the new company as a fee, called “the promote”, which is a pretty relevant dilution for other investors.

A more comprehensive summary of this process can be found in the picture below, taken from the abovementioned Harvard article — which is a very detailed source for further information about SPACs that I recommend reading.

SPACs have huge implications for speculators in the innovation economy. Venture capitalists are largely dependent on the state of the IPO market, which constitutes the primary source of returns for funds. After the dot-com bubble, not only there was a reduction in the number of IPOs; also, the average time-to-IPO has almost doubled for some categories of companies, making it more difficult to profit from venture investing. I have already written about the importance of healthy secondary markets to compensate for this trend in a past issue.

The most evident characteristic of SPACs is their relationship with the founding team. Having a renowned, charismatic guy as the leader of the company means amplifying enormously the effect that trust plays in the innovation economy. Today, investors put their money in VC funds (also) because they trust the team’s capabilities to deliver outstanding results. And this is a very rational behavior if you think about the strict relationship between VC returns and individual managers: investing in past success as a proxy for a future one is the best way to make money in the innovation economy.

However, this comes at a high cost. The 20% equity fee might prevent SPACs from scaling as the standard exit mechanism in venture capital. Startups would have many incentives to prefer SPACs over normal IPOs, as they would avoid expensive tours and complex relationships with investment banks. Also, they would have the chance to build more solid relationships with VCs that have contributed to the previous financing rounds. However, investors might think that the cost is too high to frequently enter SPAC agreements.

After all, if a startup is promising enough, the traditional IPO is still a valid exit route, as the good state of biotech IPOs clearly shows. On the contrary, if it is too risky, any involvement might end up in a disastrous deal for investors and SPAC founders. There would be an additional level of risk, partially mitigated by the trust mechanism described above: what if a WeWork kind of startup had access to a SPAC acquisition? What kind of consequences would that disastrous SPAC unleash?

To conclude, SPACs are going to be a hot topic in the coming months. Financial markets are in a sort of speculative bubble that is only partially driven by Fed policies and tech stocks. On the other hand, VCs are going to exploit the reputation of their leaders to raise money and become more and more independent from traditional IPO schemes. The two years time horizon is long enough to allow them to find a promising startup to merge with, so the risk is nothing more than the standard post-IPO one.

To be honest, I see at least two positive features of SPACs. One is the possibility to make more targeted investments into promising technological sectors that are struggling to find their way to public markets. Think about green technologies: SPACs could be an excellent way to reduce market risk (see the last issue to know more about that) of startups in this sector. The second benefit is related to the stricter relationship between the speculator and the entrepreneur, as both will have part of the equity of the new company. VCs will have no incentives in bringing to the public market founders they do not trust anymore, as their partnership is going to last longer.

Of course, there is the risk that SPACs will only reinforce the irrational speculation mechanisms that are harming the link between the innovation economy and a better future for the world. For sure, this time VCs will have to make a choice between short-term speculation and long-term investing. If they choose the latter, SPACs have a chance to be a good weapon for innovation and development.

The State

Antitrust

On Wednesday, Mark Zuckerberg (Facebook), Jeff Bezos (Amazon), Tim Cook (Apple), and Sundar Pichai (Google) took part in the congressional hearings on tech antitrust (Politico). For the most courageous of you, I am posting the link to the 5-hours hearing below.

Mark Zuckerberg, the veteran of the group for having already been questioned by members of Congress in the past, was asked about disinformation and hate content on Facebook and strategic acquisition of emerging rival companies such as Instagram. Sundar Pichai had to explain why Google Search privileges Alphabet-owned products to the detriment of rivals and which kind of relationship the company has with China. Jeff Bezos — with no doubt the most awaited of the four CEOs — had to deal with the relationship between Amazon and third-party sellers. Finally, Tim Cook was only asked a relatively small number of questions (see the chart below by The Information) about the Apple Store controversies. Take a look at this recap by Hal Singer on ProMarket to know more about the most relevant admissions of the four CEOs.

There are still some consumeristic comments about the antitrust hearings, claiming that state intervention might harm consumer utility. However, as perfectly written by Roger McNamee on The Guardian, “the CEOs appeared not to understand that the country’s values are changing, that their ‘users’ are less willing to accept all-or-nothing terms, apologies and promises to do better. Business practices that are acceptable in a startup may not be not so for a market-dominant company”. The hearings were useful to let everybody know that something is about to change and make people involved in the hard process that starts now: redesigning online markets to promote competition.

Meantime, the antitrust clash between Apple and external developers continues with new accusations towards the monopolistic structure of the Apple Store. In June, Spotify and Rakuten had focused their accusations on the 30% fee Apple receives for every in-app purchase. This time was Telegram to file an antitrust complaint to the EU, claiming that Apple should allow users to download apps from external sources (Financial Times). The growing number of accusations might convince Tim Cook that an alternative business model should be found and applied. Unlike the other Big Tech giants, Apple has benefited from not being directly involved in any major data privacy issue. However, these more traditional antitrust accusations could generate a deep and longlasting conflict between Apple and developers that could be unsustainable in the long term.

Tech regulation

Yesterday night, US President Donald Trump said he is ready to ban TikTok from the US immediately through an executive order or other emergency instruments (CNBC). TikTok has been under accusation for a month since Secretary of State Mike Pompeo declared the company a potential threat for national security, due to its data policies and strict ties with the Chinese government. For this reason, ByteDance has been very active in trying to sell or separate its TikTok business (worth $50 billion, according to its US investors), registering the interest of Microsoft in acquiring the social media app. After having lost the Indian market, TikTok could hardly afford to lose also the US one. For this reason, the deal is likely to go through further rounds in the coming weeks. After all, the ban model to manage risk associated with apps operating at the same time in China and the US could prove to be unsustainable in the long term. As suggested by Kevin Roose on (The New York Times), TikTok is also a chance to test alternative models to manage that risk, avoiding to ban apps loved by users worldwide.

Regarding the European tech regulation, The EU and the UK could soon implement new regulation measures to make the tech competitive landscape fairer, according to a new article by Adam Satariano (The New York Times). By focusing on structural market dynamics and privacy issues, European countries are already at the forefront of tech regulation; however, current measures have not generated the expected results yet.

The markets

Big Tech

Amazon, Apple, Facebook, and Google reported their Q2 results during the week (see chart below). Amazon reported sales for $88.9 billion, with $5.2 billion in profits. Apple, thanks to the outstanding results in China, reported sales for $59.7 billion and an astonishing $11.3 billion in profits. Despite the advertising boycotts, Facebook closed the quarter with $18.7 billion in sales and $5.2 billion in profits. Finally, Alphabet reported its first sales decline (-2%), closing at $38.3 billion in sales and a net income of almost $7 billion — which is much more than analysts expected anyway.

Tech industries

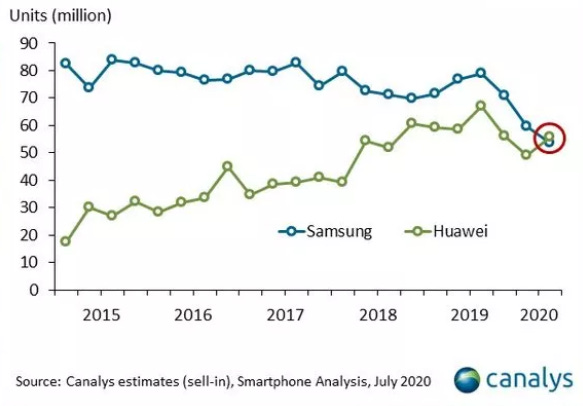

Huawei has surpassed Samsung as the world leader in smartphone sales (The Wall Street Journal). This reflects the growing strength of the Chinese giant, which is close to a very important agreement with Qualcomm to solve a legal dispute regarding 5G licensing (MarketWatch). However, since about 70% of Huawei phones are sold in China, Samsung is expected to recover the throne when international markets will recover from the coronavirus shock.

The speculators

For a daily review of the best news about Venture Capital and startups, I renew my invitation to follow The Dart, an initiative by our readers Matthieu Crétier and Francesco Fontana.

Venture capital

The telemedicine startup Ro raised $200 million at a $1.5 billion valuation in a new round led by General Catalyst (CNBC). Digital healthcare is going to grow even faster thanks to coronavirus and, as reported by TechCrunch, “investors see an opportunity to capitalize on these changes by aggressively backing the expansion plans of companies looking to bring digital healthcare directly to consumers”.

Similarly, the digital remittance startup Remitly raised $85 million at a $1.5 valuation (GeekWire). The business model of this unicorn is pretty simple, but also extremely scalable as it allows people to send and receive money across borders. This is fundamental for immigrants, who transfer part of their income to their families in their country of origin (see The big picture section below for more on that).

Financial markets

As anticipated at the beginning of this issue, SPACs are having a moment. A warning note comes from many analysts regarding this PE-styled instrument. The Economist, in particular, focuses on the conflict between Wall Street and Silicon Valley and the potential consequences for tech companies.

The big picture

The economic difficulties in the Global North due to the coronavirus shock could increase poverty all around the world, as immigrants in Western countries have to reduce the remittances they send to their families (The New York Times). This is a huge domino effect that could accelerate and amplify immigration in a non-ending loop. Also, coronavirus is having deep consequences on food security. On Science, a very recommended article points out the most impacted determinants of it.

Although no major food shortages have emerged as yet, agricultural and food markets are facing disruptions because of labor shortages created by restrictions on movements of people and shifts in food demand resulting from closures of restaurants and schools as well as from income losses. Export restrictions imposed by some countries have disrupted trade flows for staple foods such as wheat and rice. The pandemic is affecting all four pillars of food security: availability (is the supply of food adequate?), access (can people obtain the food they need?), utilization (do people have enough intake of nutrients?), and stability (can people access food at all times?).

This is somewhat linked to a topic already covered in this newsletter: is it time to revisit the Sustainable Development Goals to reflect the changes due to coronavirus? A new article by Nature explains that this is extremely necessary, especially “to decouple the SDGs from economic-growth targets”.

As a final suggestion, I highly recommend you Saffron Huang’s recent article on Palladium, which explores how Harvard (and other Western educational institutions by association) fails to form a new class of visionaries because of the managerialism that encompasses all areas of knowledge.

But management is a means, not an end, and these are not the generative activities worthy of the Harvard price tag. Students flock to career-oriented campus organizations only to learn how to manage structures that already exist, or execute a task that others have done hundreds of times before. Very few clubs create a generative and imaginative vision for your future self at work, or for what you should be working on. Although this is the stated purpose of a Harvard liberal arts education, campus culture has elevated managerialism above creation.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico