🌌 Reshaped #24

Risk in green technologies, stock bubbles, feudal land systems, climate migration, EU recovery package and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

Before you scroll down, let me tell you that this issue is quite different from the usual one in terms of content organization. I had already done some restyling before, but this is a much more relevant shift towards a better version of this newsletter. Basically, you will find all content categories (my own comments, news, journal articles, reports, etc.) mixed together and organized by topic. Topics are still provisional and I will change something starting already from the next issue (see the ending section for more on that).

Like always, your feedback is very welcome! And please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

Managing risk in green technologies

There are various classifications of risk in innovation. I have always used Larry Cheng’s nine categories of risk, but there are many others that can help explain why, when talking about a startup, we claim it is a risky venture.

All of those risks can be simplified into two major categories. On one hand, we have technology risks — will we manage to build that product? Despite being categorized into the high-tech cluster, most startups actually have low technological risk and build their competitive advantage in how they approach the market. AGI projects and biotech ventures, on the contrary, have huge technological risks and have to face a high degree of uncertainty regarding the final output of their development process.

On the other hand, we have market risk — will our product be attractive enough to reach a relevant customer base? Or how hard is it to sell in our market segment, due to complex procurement processes?

Among the sectors that VCs have backed in the last decades, biotech offers an extreme example of these dynamics. Technology risk is extreme, due to the high uncertainty about drug efficacy and institutional approval. On the other hand, as highlighted by many researchers in the field, market risk is minimized: the market dimension is basically given by the number of total cases (sometimes estimated), pricing can rely on an easily identifiable set of alternative drugs, while the state is often an early buyer.

State investments to reduce technology risk (publicly funded R&D) and market risk (public procurement) are crucial for VCs to invest in the sector. Biotech is the purest example to show the relevance of market risk mitigation to attract investments.

The opposite case is the typical B2B productivity software with a SaaS business model. Here technology risk is often minimized, as companies can rely on standardized sets of technological tools. The competitive advantage on the product side is almost entirely shifted to UX. The market risk, on the opposite, is initially very high, as the vast amount of solutions available make it hard to get the desired market position.

Here, the goal is to reach the critical mass of users to breakeven and stabilize revenue streams. Once you have stable customer acquisition, debt might be a valid alternative to VC financing for scaling the product. Even in this case, the state has a fundamental role by financing R&D and enabling early procurement — iPads in the US are a valid example, not to mention the Defense Department expenditures.

When launching a new venture, it is crucial to identify how it relates to these risks. If the goal is to get funds from a VC, ignoring the fundamental mechanisms of market risks means being out of the game. In fundamental sectors like the green revolution, the role of the state consists also in mitigating these risk factors to allow public and private actors to enter the market and have access to capital.

This means that states should not only invest in basic research — which remains fundamental to reduce technology risk. The downstream (private) applications of that R&D effort might fall far behind the expected goals due to high market risks faced by green technology ventures. And reducing the risk on the market side means primarily being open to buying these technologies in the same way the US Defense Department has done for ICT decades ago.

The European Green Deal (see this past issue for a review of criticism regarding the plan) is basically an incentive-oriented program aimed at financing the green transition. This means that the outcome of the Green Deal will depend on the best economic scenario for incumbents, which will have to adapt to the new taxonomy of subsidies. On the other side, new entrants will still face enormous market risks, unmitigated by targeted spending on solution adoption.

The positive mechanics of the innovation economy and financial speculation, in particular, can only be activated by a downwards shift of the market risk curve. Now, imagine that the technology curve follows a trend similar to that of biotech ventures: due to the evolving nature of these technologies (take energy storage as an example), the risk related to the final product is still very high. An increased effort on the R&D side would lower the risk, but not in the short term.

The short term benefits would be unlocked on the market side through parallel pilot testing of selected solutions — both public and private — and strong public spending on early adoption. The market risk curve would look similar to that of SaaS products, with even greater access to venture debt in case of a strong public stake in the venture. This way, the actors of the innovation economy would have incentives that match the goals of the green transition, while incumbents (especially in the energy sector) would not downgrade the ambition of the Green Deal by trying to defend their brownfield (carbon-intensive) assets.

The big picture

On financial markets

🎈 In a recent interview (CNBC), Mark Cuban explains why the current boom in stocks is similar to the dot-com bubble of the 1990s. The big difference lies in the huge liquidity introduced by the Fed, but the behavioral pattern is the same: the boom is not fundamental-driven and there is a diffused fear of missing the momentum — which is particularly impressive among younger investors. However, Cuban correctly warns that “everybody is a genius in a bull market”.

💴 Ant, the financial arm of the Alibaba group, is planning to launch a concurrent IPO in Hong Kong and Shanghai (CNN), with a valuation that could exceed the $200 billion. it would be one of the largest IPOs in history, with an even stronger competitive clash with Tencent — both companies are active in the fintech sector with Alipay and WeChat Pay respectively. This is also another step in the cold war between the US and China, as the latter is trying to boost national financial markets by convincing tech giants to go public there. Part of this cold war is likely to be played at the Nasdaq-Star level, which could boost a new strategic IPO window.

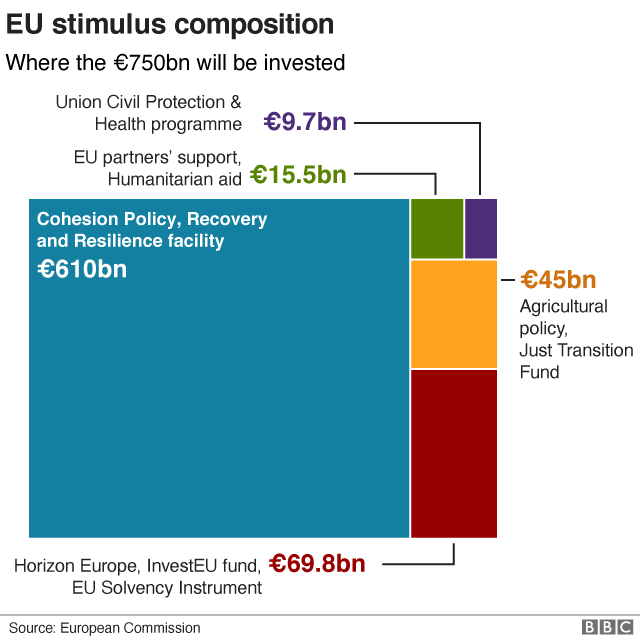

💶 After intense debating, EU leaders agreed on a recovery package worth €750 billion ($859 billion) for the post-coronavirus relaunch of the economy (BBC). The plan consists of €390 billion in grants and €360 billion in low-interest loans. Italy and Spain will benefit the most from the package, having been heavily hit by the pandemic.

On global markets

👾 Nvidia is interested in the acquisition of Arm, the chip design company owned by SoftBank (Reuters, see the last issue for more on that). SoftBank needs liquidity and is looking for a buyer; the alternative would be an IPO. The news is interesting for a couple of reasons at least. First, Arm sells IP to almost all chip manufacturers (including Intel and AMD). Such a vertical integration would be an enormous competitive advantage for Nvidia — which is why regulators would keep an eye on the eventual acquisition. Second, SoftBank is in serious trouble if it wants to sell a well-positioned company acquired at premium four years ago that generates stable revenues from the results of successful R&D.

🚗 Tesla has been profitable for the fourth quarter in a row — a record for the company. This is the biggest news coming from earnings reports in Q2, with the electric car manufacturer reporting $104 million in profits despite the shut down of the Fremont Factory and total car sales (90,650) far from the pre-pandemic record in Q4-2019 (see official charts below). Other revenue sources like emission credits were crucial for that result. Elon Musk also announced a new Gigafactory in Austin, which will be publicly accessible.

🎥 Similar news also for Netflix, which registered a record 10.1 million new subscribers in Q2 for a total of 26 million in H1 2020. The growth in customer acquisition, partly due to the pandemic, is huge: in 2019 the company “only” added 28 million new subscribers (see chart below). The forecast that customer acquisition might slow down in the second half of the year, however, had negative effects on the stock price.

On healthcare

💉 The US committed to a $1.95 billion deal with Pfizer to buy 100 million vaccines for COVID-19, which will be distributed for free to the population (The New York Times). This is uncommon, as it is the private sector the usually does the purchase in the US. However, governments pay significantly lower amounts for vaccines, which is why the drug industry has lobbied to achieve such a deal. Together with Merck and Moderna — which received $483 million in government financing — Pfizer is among the companies that declared to be willing to profit from the vaccine (PharmaPhorum); on the opposite, AstraZeneca and Johnson&Johnson will price their vaccines at cost.

🩺 Healthcare is at the core of the international debate for the first time in a while. According to a new report by McKinsey, the most promising innovations in the sector are “genomics to deliver more targeted prevention and treatment; data science and AI to detect and monitor disease and enhance research; tech-enabled delivery to expand and reimagine access; and advances in the understanding of the biology of aging”. However, the authors correctly point out that two major systemic shifts that are needed in order to generate the desired impact: first, a greater R&D effort is necessary on the private side; second, the rewards structure should be redesigned to create incentives in investing in developing countries.

💰 The new visual representation of healthcare and military spending per country by Visual Capitalist has some shocking revelations.

On antitrust

💻 Slack presented a complaint to the European Commission, accusing Microsoft of unfair behavior. Basically, the integration of Teams into the Office suite makes competitor applications useless for the user. As reported by Richard Waters (Financial Times), however, Slack will now have to prove these accusations, and it will not be an easy task. Integrating an application into a suite is not a crime, especially if users get huge benefits from that. Slack continues to address slightly different needs — as declared by the company itself months ago — and has ambitious goals for improving team communication. We could say that Slack aims at making Teams obsolete, which is what companies should do to compete in tech markets: innovate. In the end, according to Tom Warren (The Verge), the big winner of this clash could be Google, which is going to radically improve the G suite in the coming months.

🎧 Italian antitrust authorities are investigating Apple and Amazon for anti-competitive cooperation in selling Apple products and Beats headphones, preventing external retailers from accessing this channel (CNBC). Amazon was also accused of copying the products of startups previously met for investment purposes (The Wall Street Journal).

🛑 I am skeptical about the efficacy of breakups in most cases, especially in tech — and, generally speaking, all sectors based on intangible assets. But this paper by Rory Van Loo is based on an interesting perspective: according to the author, regulators are concerned about the radicalness of breakups and fear their consequences on the economy. I tend to see antitrust as purely related to market-fixing, which encompasses more layers of complexity than mere organizational size. On that topic, Viktoria H.S.E. Robertson (ProMarket) provides an interesting analysis, starting from the European perspective on how to update the antitrust market definition. This is a recommended read for those who love the intersection between law and economics.

[…] dynamic and digital markets represent an important challenge to market definition because of their fast-paced nature, their data-driven business models and the blurring of market boundaries through the integration of both technologies and markets.

On social media

📱 American ByteDance investors, including Sequoia Capital and General Atlantic, are considering the acquisition of TikTok (The Information), which is under siege all around the world due to concerns over data privacy. The popular social network was recently banned in India and is being copied by many app developers willing to exploit bans and skepticism to gain a critical mass of users. The deal is likely to succeed, as in the last weeks ByteDance seemed to be keen on considering the sale of the social network’s majority stake. Such a move would prevent a national ban in the US, which could prove deadly for the app. This story is extremely relevant to understand the new dynamics of tech geopolitics. On one hand, governments have an unprecedented weapon to determine the success or the failure of social networks: the ban. Users get angry, but only until a proper substitute is found. On the other, financial actors can speculate on the value of these ventures by carefully monitoring the political landscape and push for strategic takeovers.

🤐 Twitter, which reported a 19% drop in revenue in Q2, announced stricter rules towards QAnon, the popular US conspiracy theory (Wired). Social media were crucial in making us understand more practically what free speech really means. And, according to Twitter CEO Jack Dorsey, some kind of moderation is necessary to prevent social networks from being exploited to spread violent or fake messages to large audiences. If the choice of Twitter is clear, Facebook is still lacking a clear policy on that issue.

✂️ LinkedIn is going to lay off 960 employees (6% of the total workforce) in its Global Sales and Talent Acquisition divisions (Forbes).

On science and technology

🧠 OpenAI just opened its GPT-3 language model to beta testing to explore all of its potential applications. We are still far from the artificial general intelligence (AGI) the company is trying to achieve (MIT Technology Review), but the tool has some impressive potential.

😠 The new European recovery plan will allocate €81 billion ($94 billion) to the upcoming flagship research program, Horizon Europe, which is going to start in 2021. The world of scientific research is disappointed, as the total amount is less than previously promised (Nature).

On social justice

🏡 During the lockdown, when workers were fired and businesses collapsed, there still was a category of people that continued to get their revenues as if nothing was happening: landlords. Alastair Parvin (Medium) started from this observation to criticize the dominant land system, as “land value is not created by the owner. It is created by the taxpayer through our investment into infrastructure, and by the activity of the community, and our collective consent for development”. The existing land system is just “a legacy of the feudal system that has persisted simply through unconsciousness, vested interests, corruption and obfuscation”. If we all agree that land is a natural commons, the value it generates should be redistributed to the whole society. It is not a case if only a minority of economists have found a socio-economic (and moral) justification to rent-seeking behaviors. On the other hand, politicians find it hard to address the issue because of its relationship with private property sacredness — even if potential solutions, like land buybacks, have nothing to do with it.

🌍 As average temperatures increase and more and more lands become unhabitable because of climate conditions and harsh food production, people from the Global South will have no alternative to migrating to other places. As explained by Abrahm Lustgarten (The New York Times), climate change will force rural residents to relocate to large cities, with huge consequences on urban development. “Around the world, as people run short of food and abandon farms, they gravitate toward cities, which quickly grow overcrowded”. According to estimates, by 2030 about 40% of urban residents might live in slums with terrible living standards. The following step is climate migration. In this scenario, developed countries will face two responsibilities: mitigate the consequence of climate change worldwide and be flexible with their borders. Both are at the core of the international debate, but results are far from encouraging.

On other news

🎵 Spotify signed a licensing deal with Universal for future marketing cooperation (TechCrunch).

📡 Uber signed a deal with Google Maps to access its rides and delivery services (Yahoo Finance).

💬 eBay is going to sell its classified advertising business to Adevinta for $9.2 billion (SiliconANGLE).

Thanks for reading.

I hope you enjoyed the new structure. Starting from the next issue, it will be a bit less chaotic. Except for the initial essay, all topics will be categorized into three main sections: markets (technological industries, Big Tech, startups), finance (financial markets and venture capital), and the state (innovation policy, antitrust regulation, public finance). Additional sections will be dedicated to the most recurrent topics of this newsletter, which constitute a fundamental background for the innovation economy, ranging from social justice to economics.

My objective is to keep track of the big evolutions in all of these areas — and, in turn, to keep you in the loop with my picks.

Did you forget to share reshaped?

Have a nice weekend!

Federico