🌌 Reshaped #51

Short edition: satellite rivalry, digital regulation, productive bubbles and... not much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

Another busy week, another short edition. In case you missed the last issue, my friend Matthieu and I launched a new podcast! You can listen to The DART Bullseye on Spotify, Google Podcasts or Apple Podcasts. This week, Matthieu met Siddharth Choksi, Venture Partner at Kaiku. If you are interested in venture funding, I can guarantee you will like this episode.

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

Policy

On ProMarket, Alexandre de Streel — who, less than a year ago, co-authored an important paper titled Designing an EU Intervention Standard for Digital Platforms — explains that the European Digital Markets Act is based on four pillars. Three of them — ex-ante regulation, the possibility to maintain vertical integration in exchange for openness and market contestability — are already part of the regulatory tradition of the EU. The fourth, on the contrary, is an innovative feature: for the first time, indeed, the Digital Markets Act will “confer fully-fledged regulatory power to the European Commission instead of conferring these powers to the national authorities of its Member States”.

This new role of the Commission will be challenging, in particular if it wants to share the same characteristics that EU law imposes upon regulatory authorities at the Member State level. […] The Commission should also have sufficient human and financial resources to deal with extremely complex and, at times, new issues in markets which are evolving quickly and often under high levels of uncertainty.

This is a huge step for the EU. Reducing regulatory frictions in the continent is fundamental to build an efficient European tech ecosystem. The market contestability principle is meant to favour new entrants; however, excessive legal fragmentation could strongly damage the latter. After all, bureaucracy is still perceived as the biggest constraint in the development of European innovation (see Reshaped #44).

The other side of the coin is about building effective cooperation processes between governments and tech companies. Nonetheless, this is far from simple: one of the main areas of concern about Biden’s presidency has to do with his ties with the Silicon Valley elites. A recent article by Jonathan Guyer on The American Prospect explains how Google former CEO Eric Schmidt is attempting to gain control of some key public procurement processes through a mysterious startup called Rebellion Defense, which he funded months ago. This is a very good piece I highly recommend. One point, in particular, caught my attention: to overcome backlash towards the military application of advanced technologies provided by Big Tech companies, Schmidt thought about building ad hoc startups that could be perceived as “defense companies”.

As reported by Axios, Schmidt is also among the signatories of a proposal to challenge the asymmetric Chinese competition on technology markets through a “new era of technological statecraft”.

➡️ The UK will cooperate with partners such as Egypt, Bangladesh, Malawi, Saint Lucia and the Netherlands to support global communities threatened by climate change (Reuters).

➡️ On Rest of World, Alaphia Zoyab criticizes the systemic damage that social media platforms generate far from the Western world by allowing populist leaders to spread violent content.

Technology

While SpaceX is close to a new round that would value the company at about $60 billion (Business Insider), Elon Musk is at outs with Jeff Bezos. The former is trying to convince the US Federal Communication Commission to allow the company to move its Starlink satellite constellation to lower altitudes. This, however, would be detrimental for Amazon, which built its Kuiper constellation so that it would not generate any interference with Starlink. In a statement to CNBC, Amazon claims that “those changes not only create a more dangerous environment for collisions in space, but they also increase radio interference for customers”. What happens when two national champions compete for the same space in their industry? This is a key issue in economics when state-sponsored industries enter their development phases.

In addition to internal competition, governments have to cope with an increasingly intense international rivalry in the space economy. According to Anne-Marie Slaughter and Emily Lawrence, however, the best strategy for the US and China would be to cooperate at least in “setting norms for commercial activities in space” (Project Syndicate).

The next phase of competition in space will be to establish a mining base on the Moon. Lunar mining is important for two reasons. First, ice on the moon’s surface can be converted into hydrogen and oxygen and used as rocket fuel, which is crucial for deep-space missions. The second reason is closer to home: the moon’s surface contains highly valuable rare-earth metals that are used in technologies like cellphones, batteries, and military equipment. China currently produces approximately 90% of the world’s rare-earth metals, giving it significant leverage over other countries, including the US. By sourcing these metals from the moon, countries could reduce their dependence on China.

➡️ General Motors announced that “it would phase out petroleum-powered cars and trucks and sell only vehicles that have zero tailpipe emissions by 2035” (The New York Times).

➡️ Companies are using the design of cryptocurrencies to overcome the power of Big Tech giants and decentralize power (The New York Times).

Finance

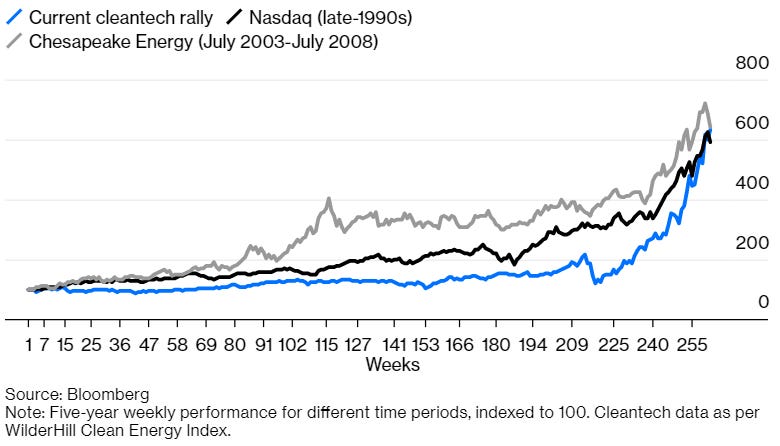

The week in finance was dominated by the absurd GameStop rally. The interpretations of this phenomenon vary — see Brett Scott, John Authers, Matt Levine or Andrew Ross Sorkin. For a summary of the whole GameStop story, see CNET. Meanwhile, on Bloomberg, Liam Denning explains that, while the state-sponsored cleantech boom could be described as a bubble, it could prove to be a productive one.

Like the stock market in general, this has all the hallmarks of a bubble: high multiples, rapid price increases, a big (and vocal) retail element and a cool story to justify it all. It feels like we’ve been here before. […] As we all know, bubbles aren’t good. On the other hand, that doesn’t mean their only legacy is flyblown Florida subdivisions, pointless dotcoms and shredded egos. Economist Ruchir Sharma coined the phrase “good binge” to describe a frenzy of investment that, even though it might ultimately end with a crash, leaves behind some productive asset or advantage. That doesn’t apply to flyblown Florida subdivisions. But it does to useful things like railroads, the Internet, shale, fiber-optic networks and gas-fired power plants.

The need to accelerate energy transitions could hardly be sustained without some frenzy in equity markets, which, in turn, are boosted by the availability of cheap money. Hence, despite the shape of the curve could worry investors and policymakers (see chart below), at the end of the rally we could have accelerated a process that could have taken too much to generate decent results in both technological and market development.

➡️ Chamath Palihapitiya is considering running for governor in California (Axios).

➡️ Rober Downey Jr. announced he is launching the FootPrint Coalition, a VC focused on sustainability startups (TechCrunch).

➡️ Guess who is trying to combine with a SPAC at a $10 billion valuation? WeWork, of course (The Wall Street Journal).

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico