🌌 Reshaped #32

Tech IPOs, European energy policy, biotech acquisitions, TikTok banned, corporate social responsibility and much more

Welcome to a new issue of Reshaped, a newsletter on the social and economic factors that are driving the huge transformations of our time. Every Saturday, you will receive my best picks on global markets, Big Tech, finance, startups, government regulation, and economic policy.

Due to some unexpected events that captured my time and attention during the week, I had to postpone the second part of my excursus on welfare reforms to next Saturday. But I promise you will have the chance to read some interesting news and articles about the tech IPO wave that became reality this week (see The speculators).

Please, take a moment to share this newsletter with your network!

New to Reshaped? Sign up here!

The state

According to The Wall Street Journal, the US Federal Trade Commission is preparing an antitrust suit against Facebook for anticompetitive behavior in the social media market. Facebook is the Big Tech giant that has struggled the most with antitrust accusations, especially after the Cambridge Analytica scandal of 2018. Now, the most recent accusation is about Facebook spying Instagram users through iPhone cameras (Bloomberg). The company claims it is just a bug — and it is probably so, due to the delicate moment Facebook is living and the enormous consequences that such a discovery could generate.

Nonetheless, this makes it even more evident that we need stricter technology regulation and privacy protection rules. The problem that regulators should address is not about Facebook spying Instagram users through smartphone cameras. It is about the power that Facebook has to do so. Regardless of their actual behavior, tech giants should be prevented from having the very possibility to do harm to their users. We cannot pretend users to trust tech companies or, even worse, be uninterested in the many dangers of their online presence. In the internet economy, a potential threat of this magnitude is as serious as a current one.

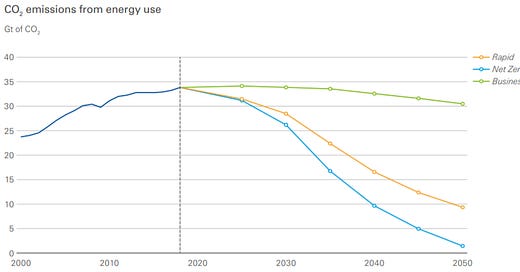

And now, a brief excursus on energy and climate change. The new BP Energy Outlook is plenty of invaluable data and insights about the energy sector. The report is built around three different scenarios, reflecting the potential evolution of the industry from now to 2050 (see chart below).

The Rapid Transition Scenario (Rapid) posts a series of policy measures, led by a significant increase in carbon prices and supported by more-targeted sector specific measures, which cause carbon emissions from energy use to fall by around 70% by 2050. […] The Net Zero Scenario (Net Zero) assumes that the policy measures embodied in Rapid are both added to and reinforced by significant shifts in societal behaviour and preferences, which further accelerate the reduction in carbon emissions. […] The Business-as-usual Scenario (BAU) assumes that government policies, technologies and social preferences continue to evolve in a manner and speed seen over the recent past.

The chart shows a peak in emissions during the 2020s in the BAU scenario. Here, the shock caused by COVID-19 plays a key role in the direction of energy policy. And the European Union seems well positioned to lead a green transition (see chart below). A recent article by Andreas Kluth on Bloomberg explains how the EU Commission is trying to bundle together economic recovery and green growth policies, which is made harder by system interdependencies. However, the EU could pave the way for a new kind of climate policy oriented to “stop subsidizing things labelled green with public money, and to instead focus entirely on charging a price for things that are brown, then recycling the money that’s earned”.

This means enlarging the existing European emissions-trading system, which “fixes the amount of carbon that certain industries, such as steel makers or power generators, may emit. Companies then have to buy allowances, which they can resell to other firms if they don’t need them”. This proposal is far from close to the kind of ambitious policies needed to reach the Rapid or Net Zero scenario described above. And it is also far from innovative. However, it could finance not only green initiatives in the EU, but also the recovery measures taken to save the European economy from the effects of the pandemic. This may prove fundamental to provide evidence about the feasibility of a green path towards recovery and growth.

The markets

This had to be the week in which all doubts about the future of the TikTok saga could come to an end. Instead, we are still living the same uncertainties and creating new ones. But let me recap the fundamental steps of this summer tech epopee:

The US government raises doubts about the security of TikTok and other Chinese consumer applications;

Meanwhile, India announces a ban on TikTok and many other Chinese apps;

The US government urges ByteDance to find a buyer for the American division of TikTok to avoid a ban in the country (with more than 100 million users);

Microsoft (in partnership with Walmart) seems to lead the race to buy the entire TikTok, but Oracle is a serious contender due to its ties with Donald Trump.

This week, Oracle seemed to have finally won the race — even if not as a buyer of TikTok but only as its “trusted technology partner” with the following terms (Axios).

(1) Oracle will have the exclusive ability to oversee all tech operations for TikTok in the U.S. (2) Oracle will review TikTok's source code and related software to ensure there are no backdoors. (3) Oracle will also be able to review all updates to TikTok's software to ensure no adverse changes are made.

Meantime, Donald Trump was pushing for a majority stake acquisition of TikTok by a US-based corporation (The Wall Street Journal). The agreement between Oracle and ByteDance was not enough for him, so he banned TikTok and WeChat from the app stores (The Guardian). Now, many analysts expect an IPO of TikTok in the US, with Oracle and Walmart somewhat included in the deal. But this is just the plot of an episode to be released next week!

However, the major news of the week in technology markets is not about social media, but biotech. Gilead announced an agreement to acquire Immunomedics for $21 billion in cash, aiming at improving its oncological portfolio. Indeed, this acquisition means Gilead will commercialize Trodelvy, a drug “for the treatment of adult patients with metastatic triple-negative breast cancer” (European Pharmaceutical Review). This shows that M&As in the biotech and pharmaceutical industry are not suffering from the negative effects of the pandemic as expected.

The speculators

During the last month, we have seen a growing interest in tech companies planning to go public. The hype around tech startups and the FOMO of the most diverse investors have driven the current wave of IPOs. The most recent success among those startups is Snowflake, a cloud-based data platform that went public on Tuesday, raising $3.4 billion in the biggest software IPO of all times (The Wall Street Journal). With an IPO price of $120, Snowflake closed at almost $254, with an astonishing $70 billion market cap. Again, Snowflake is still far from profitability, but revenues are increasing at an incredibly fast rate. Investors are buying growth potential and increasing gross profit margins, which is a proxy of how sustainable that growth could be (TechCrunch).

However, the scarcity of IPOs — that is, the scarcity of exit opportunities in the public markets for founders and venture capitalists — makes IPOs themselves more and more precious. In turn, this pushes founders and their financial backers to find some alternative paths to public listing, where they can better capitalize on the gains of initial shares trading. In other words, they want to avoid the costly intermediation of investment banks through direct listing or SPACs. It is not a case if the latter has had incredible growth in 2020. The most recent example of that trend is the successful IPO of Reid Hoffman’s and Mark Pincus’ SPAC company, which raised $600 million (Bloomberg).

To some extent, we might say that the resilience of Big Tech giants in front of the pandemic has had positive effects on smaller tech companies (The New York Times). This explains why investors accept to bet on unprofitable ventures with a clear growth path and a fragmented industrial structure — which is exactly the case of Snowflake. Other successful IPOs show the same dynamics. On Wednesday, JFrog (an artifact management platform for DevOps) went public with aggressive pricing based on strong growth expectations and tech stocks exuberance (Forbes). Yesterday, Unity Software (a platform for game development) did the same in an IPO that could reshape the competitive landscape of e-games (CNN).

But the IPO window is still open for other companies, as we are still waiting for the direct listing of Palantir and the much hyped IPO of Ant Financial, which may be the biggest ever. On MarketWatch, Mark Hulbert compares this IPO wave to the dot-com bubble, with some interesting contributions that enrich the “tech bubble debate”.

Then there was a huge disconnect between the valuations of the tech sector and the rest of the market. Today, in contrast, all asset classes have subdued expected future returns. This reduces the likelihood that there will be a big reset in the valuations of one asset class relative to others […].

The big picture

In 1970, in the New York Times Magazine, Milton Friedman published an essay called The Social Responsibility of Business Is to Increase Its Profits. The basic theory of this essay was that “there is one and only one social responsibility of business — to use its resources and engage in activities designed to increase its profits”. The influence of this theory in corporate governance structures over the following decades has been unrivaled. Most of all, it helped to solve one of the most critical aspects of modern organizational models: the principal-agent divergence of goals and expectations between the shareholders and the executives of a corporation.

Fifty years later, this theory still holds (McKinsey), despite the recent commitments to a more open and sustainable form of corporate governance laid out by the Business Roundtable — see this recent critique by former Democratic candidate Elizabeth Warren for more on that. There are several different opinions about why corporations struggle to go beyond profits maximization — including that this is their real and unmodifiable nature. I would love to read your thoughts about that topic!

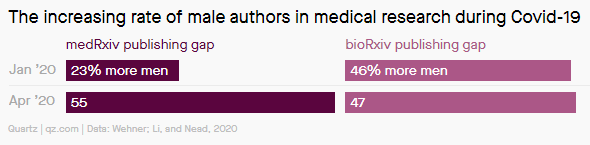

Some days ago, Quartz reported some interesting analyses about the gender gap in science research, worsened by the COVID-19 pandemic. During the lockdown, female scientists had to cope with an increase in domestic efforts, especially related to childcare. Hence, their scientific production dropped (see chart below).

This is one of those gender gap factors that often go unnoticed and that we should solve by applying intelligence system adaptations. As perfectly explained by Hillary Rodham Clinton on The Atlantic, every major change starts with some sort of awareness about the unfairness of our current condition.

25 years ago, speaking in Beijing as first lady, I thought I had reached the peak of power and influence that would ever be available to me. I was determined to use it to lift up the concerns and rights of women. Yet it turned out my journey was far from over, and I would get the chance to carry those concerns into the highest levels of government and politics. What we think are peaks can turn out to be frustrating plateaus. But they also can be way stations on a higher climb.

Thanks for reading.

As always, I am waiting for your opinion on the topics covered in this issue. If you enjoyed reading it, please leave a like (heart button above) and share Reshaped with potentially interested people.

Have a nice weekend!

Federico