🌌 Reshaped #20

ESG funds and the struggle to save the world, Amazon into VC, public venture financing, antitrust taking the lead and much more

Welcome to a short issue of Reshaped, a newsletter for those who do not want to miss a thing about the huge transformations of our time.

I have been traveling a lot during the week, with just a few hours available to write this issue. Hence, you will find no essays or reviews this time. However, do not miss the contributions in the Alternative perspectives section, especially regarding ESG funds and their impact on fighting climate change.

New to Reshaped? Sign up here!

News

💵 Amazon will launch a $2 billion VC fund to tackle climate change by investing in new technologies for decarbonization (The Wall Street Journal). The fund will invest in a variety of sectors, from energy to transportations, and is part of the Climate Pledge signed in September. In the meantime, Amazon announced the successful acquisition of the autonomous driving startup Zoox for $1.2 billion (Financial Times), while British authorities have authorized the investment in Deliveroo (TechCrunch).

📍 The UK will take control of 20% of the bankrupt company OneWeb to build its own GPS (The Telegraph). After Brexit, the UK had lost military access to the European network Galileo, so the acquisition was definitely necessary for the government.

📉 Wirecard has filed for insolvency in the midst of a huge scandal that brought the CEO to jail (Business Insider). More precisely, €1.7 billion were missing from its balance sheet in a failed accounting trick. The company was backed by SoftBank with a $1 billion injection.

💿 Apple announced it will produce its own chips for the Mac product line (Axios). This will end the partnership with Intel, started in 2005, within a couple of years. Some analysts expect lower sales in the second part of the year due to customers waiting for the new models — but it is worth remembering that Macs have a minor impact on the overall revenues of the company.

⛔️ German antitrust authorities have ruled that Facebook has illegally acquired data from its users exploiting market dominance (The New York Times). This is just another sign of the growing antitrust movement both in Europe and in the US, where William Barr seems to be more active than ever. In the EU, Luxembourg and Ireland are pressed to regulate more strictly how Big Tech manages Big Tech (Reuters).

Alternative perspectives

🎁 On VentureBeat, Douglas Campbell criticizes the abuse of SBIR funding in the US, where companies with no commercialization purposes exploit public money only to finance their product research. While still relevant, the SBIR program needs to be reformed to push for more market-oriented venture building.

So how do we streamline the SBIR program in order to make it more effective? Simple – put limits on the amount of funding a company can receive from the SBIR program, either cumulatively or annually. A key litmus test is the answer to the following question: Will this company be out of business if the SBIR program were to disappear tomorrow? If the answer is “yes” and the company is more than 10 years old, then it clearly has a business model based on being subsidized by U.S. taxpayers and should be allowed to go out of business in order to make room for the next generation of startups.

I am very skeptical of startup-as-an-output public programs, but I agree with the author on the importance of a clear and measurable go-to-market strategy for publicly funded ventures. Unfortunately, the problem highlighted also affects EU funding schemes.

✂️ On Mother Jones, Kevin Drum explains why tax cuts applied by Donal Trump were harmful to the US and how Democrats could escape the trickle-down trap. The long article provides a list of all lies Republicans did to make citizens accept those cuts as beneficial for the economy.

Why does this matter? For two reasons—one, lies about tax cuts have determined the course of America’s economy, and the individual fortunes of millions of families including yours, for decades. Many of the inequities laid bare by the pandemic have been in the making since the Reagan era. And two, amid the coronavirus crisis, we’re about to have another debate over whether tax cuts can juice the economy. To evaluate those claims, it behooves us to look at what Republicans said about their 2017 tax cut—compared to what actually happened. Spoiler alert: Every single economic indicator Republicans said would go up, didn’t.

🌱 Green finance was the main topic of the first issue of Reshaped, about four months ago. Last week, The Economist returned on the topic with an excellent analysis of ESG funds and their effectiveness in improving the sustainability standards of global industries. Three main factors work against those funds: the huge emissions by publicly listed and state-owned companies, the opaque measurement system (ESG ratings), and scarce incentives to reduce environmental impact.

Some European bank regulators hope to cut emissions indirectly, by imposing climate-stress tests on lenders and insurers that penalise their exposures to dirty or vulnerable projects. But the evidence so far suggests that this will not make much difference (assuming there is no change in rules on carbon emissions). […] Governments need to force firms to improve their disclosure. Asset managers need to drop the gimmicks and set coherent and measurable objectives. Most important, widespread carbon taxes would unlock the power of finance, giving investors and banks a strong motive to shift capital away from dirty industries to clean ones and to develop instruments that allow firms to hedge and trade the price of carbon.

As I wrote in the abovementioned issue, we should not have too much faith in ESG funds as changemakers in all of their areas of influence. They were born for financial ends, not environmental or social ones. But, as often happens in finance, ESG funds brand themselves as that kind of changemakers, with a narrative that is far from reality and generates distorted expectations.

Other readings

🎯 In the last issue of New Internationalist (Could the SDGs Deliver on Their Promise?, p. 48), Gary Rynhart and Jan Vandemoortele debate on the effectiveness of UN’s Sustainable Development Goals (SDGs) as a practical tool for global development.

💻 On a new blog post, Benedict Evans explains how Zoom is probably going to face a process of commodification of video applications similar to what happened to Skype and Dropbox for VOIP and file sharing respectively. On top of this new commodity, a new range of apps will emerge with video conferencing as a basic internal instrument.

📧 On The Verge, Tom Warren explains how Slack could be close to meeting its goal: killing the email. While it was relatively easy to take the lead over internal emails, it was hard to cope with inter-organizational communications.

📖 On Nature, Heidi Ledford examines how easily accessible data troves, including social networks, are changing social sciences, which are becoming more and more popular among researchers with computational backgrounds — not without conflicts.

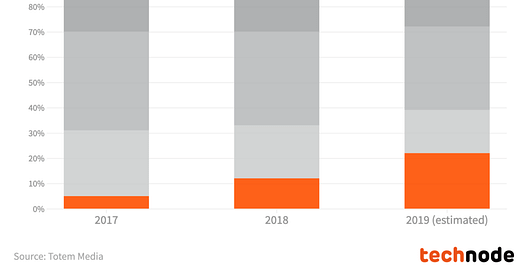

🦄 CB Insights has produced a new report on ByteDance, TikTok’s owner company, now valued at $140 billion — the highest valuation among unicorns in the world. Take a look at the chart below to catch the impressive growth in advertising shares among Chinese tech companies.

🤖 What if VC investments could be decided by artificial intelligence? As reported on Axios by Bryan Walsh, EQT Venture did something similar with its Motherbrain platform.

Thanks for reading.

Please give me any feedback about this issue. If you enjoyed reading it, like and share Reshaped with potentially interested people.

Have a nice weekend!

Federico