🌌 Reshaped #2

5G and U.S. protectionism, OpenAI reshaped, Facebook's regulation, public data commons and much more.

Welcome to a new issue of Reshaped, a newsletter for those who do not want to miss a thing about the huge transformations of our time.

This week I will focus on the war between the U.S. and China on 5G technologies and the apparently surprising call for regulation by Big Tech corporations. In case you missed the first issue, you can read it here.

New to Reshaped? Sign up here!

News on tech innovation

💥 A new article by Karen Hao investigates how OpenAI, one of the world-leading research companies on artificial intelligence, is being transformed by the need of speeding up its R&D process and generate revenues (MIT Technology Review).

💰 Niklas Zennstrom, a co-founder of Skype, announced the launch of Atomico, a new venture capital fund focused on European high-tech startups.

🚄 Rail transport giant Alstom has reached a preliminary deal to acquire Bombardier’s train business unit for more than $7 billion. The Canadian Caisse de Dépots et placement du Québec will become the majority shareholder of Alstom (The Wall Street Journal and Reuters).

💵 Jeff Bezos will launch a $10 billion fund dedicated to fighting climate change (Bloomberg), even if many found the move contradictory (The Guardian).

🧫 New antibiotics produced by artificial intelligence will make it possible to fight bacteria that were considered unbeatable until now (Nature).

📃 Big Tech loves regulation

On Monday, Mark Zuckerberg has visited the European Union to meet officials in Brussels (The New York Times and Financial Times). He said that regulation is necessary to grant a fair future to artificial intelligence. Despite being a negative factor in the short term, Zuckerberg is convinced that regulation will strengthen Facebook, helping the company win user trust (Bloomberg). He was also open to an increase in the taxation of Big Tech in Europe, a source of frustration for both citizens and institutions (BBC). The same day, Facebook has released a white paper with its suggestions on how to regulate online content.

Until now, Facebook had adopted a more hostile approach to regulation than Microsoft or Google. This change makes it clear that Big Tech has a huge interest in being a protagonist in the regulation game. Indeed, regulation hurts primarily incumbent companies, as it raises the complexity of legal accomplishment, product design, and go-to-market. This reduces the threat of new entrants, making the tech ecosystem less dynamic, which is the fundamental objective of digital monopolies. What governments all around the world should focus on to reduce the threats coming from artificial intelligence and tech corporations has a lot more to do with business architecture than data regulation.

📡 5Geopolitics

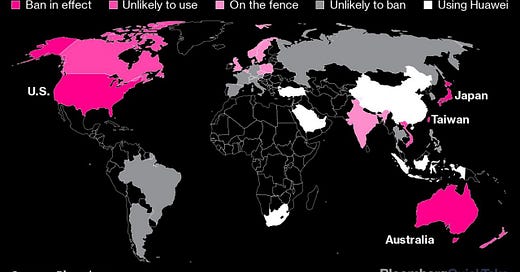

The international relations map of Huawei needs an update. After the United Kingdom (BBC), Germany seems ready to allow Huawei to market its 5G technologies in the country. As reported by David E. Sanger and David McCabe in The New York Times, the main reason for Germany not to enter the battle against the Chinese giant is related to potential negative consequences for the automotive sector, which heavily relies on exports to China. Moreover, the U.S. is finding it difficult to prove any illegal behavior from Huawei during the many years the company has been working in Europe.

Until now, the U.S. has focused its efforts on trying to highlight the threat of letting the Chinese autocratic government access sensible intelligence data, which could be used as an instrument of remote mass-surveillance not only in communications but also in mobility, industry 4.0 and the military (The Diplomat). This is a truly bipartisan argument, linking even Donald Trump and Nancy Pelosi (Bloomberg). The government is trying to go even further, refusing to allow Huawei access to critical technology while investing money in R&D projects with the potential to create a common architecture for all 5G enablers. However, despite all those efforts, the U.S. is falling short of viable alternatives for European countries willing to adopt 5G.

Last week, Attorney General William Barr has set the scene for a U.S. controlling stake (both public or private) in European giants Nokia and Ericsson, a proposal that Margrethe Vestager has publicly endorsed (CNBC). Those companies are the main competitors to Huawei in the 5G technology segment, but the business scenario is hardly comparable. Huawei benefits from Chinese tariffs and a strict relationship with the national government, which translates into huge public R&D spending and international lobbying. However, the Attorney General's proposal seems to outline a scenario in which the US replicates the Chinese model instead of breaking it down.

This new chapter of the cold war between China and the U.S. comes at a time of intense debating among E.U. leaders on which road to take to restore a European tech industry capable of competing with American and Asian companies (Politico). Nonetheless, the E.U. seems to be stronger at enforcing antitrust against Big Tech than at developing its own version (The New York Times). The E.U. has recently released a toolbox inviting member states to take into account the risk of 5G suppliers, without explicitly referring to Chinese companies. Far from being a ban for Huawei, the toolbox declares the intentions of European countries: fill the gap in whatever form, with the lowest risk possible, and with the objective of being competitive for the next big technological innovation. The bet, as many experts argue, is that 5G will be a bridge for the much more powerful 6G technology, provided that the former will continue to have a slow scale phase.

Barr’s proposal regarding an American acquisition of Nokia and Ericsson seems far from reality. Besides the feasibility of such a gigantic move, it would raise concerns about this form of state capitalism. For this reason, the U.S. government would favor the emergence of a national corporation instead. The natural choice would be Qualcomm, already active in the industry as one of the leader suppliers of 5G microchips (The Economist). The company could have no interest in entering the low-margin 5G networks market, characterized by an unclear future both on the technical and the political side. Nevertheless, Qualcomm has a serious antitrust problem, and the D.O.J. is at the moment a useful ally.

As highlighted by The Economist, this urgency to block the expansion of Chinese 5G by the U.S. seems to be more justification for protectionism than a decisive step in the geopolitical war between the two countries. The support to Qualcomm in its antitrust troubles by the U.S. government and the proposal to take a stake in Nokia and Ericsson go precisely into that direction. The upcoming elections in the U.S. complete the picture. With Bernie Sanders and Elizabeth Warren - both explicitly favorable to breaking up Big Tech - as potential Democratic candidates, Donald Trump and the Republican Party need to strengthen their ties with the corporate world. The 5G geopolitics set the perfect scene for pro-monopoly, protectionist moves aimed at granting a new mandate to the President.

Alternative Perspectives

✂️ In a recent article on Foreign Affairs, Ganesh Sitaraman makes the case for breaking up Big Tech. A popular pro-monopoly thesis claims that big tech corporations are so profitable that they can avoid engaging in Chinese markets, thus avoiding external pressures, and invest more in R&D. However, this “national champion” model has often proved to be a limit to innovation and an incentive to corruption (yes, Andrew Mellon’s Alcoa is still a good case study). The author suggests that breaking up Big Tech would not weaken tech companies, already gigantic and extremely profitable. Citing economist Mariana Mazzucato, he recommends a national public spending in R&D and the creation of public data commons.

Mountains of data are needed to improve AI’s precision and accuracy, and some might think that only Big Tech can collect and handle data in such vast quantities. But this need not be the case, either. The United States could create a public data commons with data collected from a variety of government sources (and regulate it with strict rules about personal privacy), for use by businesses, local governments, and nonprofits to train machines.

📈 Last week I reported an article from The New Yorker about prosperity without growth. From a similar perspective, Thomas Roulet and Joel Bothello from the Harvard Business Review (Why “De-growth” Shouldn’t Scare Businesses) claims companies should consider the current trend of lower consumption levels as a strategic option. The design of more durable and modular products, a value chain repositioning that favors stakeholder engagement, and standard-setting for other industrial players are viable best practices.

As we continue to grapple with climate change, we can expect consumers, rather than politicians, to increasingly drive degrowth by changing their consumption patterns. Firms should think in an innovative way about this consumer-driven degrowth as an opportunity, instead of resisting or dismissing the demands of this small but growing movement. Businesses that successfully do so will emerge more resilient and adaptable […].

Degrowth as an economic option is also addressed by Yves Smith in an interesting post on Naked Capitalism. On the opposite, Andrew McAfee is convinced that growth is the only way to a sustainable future (Newsweek).

Other readings

✋ In the January issue of the New Internationalist, philosopher Alex Sager imagines a world with no borders (Open borders, 2050).

🌲 Henry Olsen from The Washington Post clarifies how the government initiative to plant a trillion trees cannot be considered a socialist movement, as argued by the conservative Club for Growth. The move is part of a bigger plan to favor carbon sequestration, a far less ambitious choice than the Green New Deal promoted by Alexandria Ocasio-Cortez.

👵 Jeanna Smialek from The New York Times argues that Millennials, who are generally willing to save money and retire early, could make it difficult for the Federal Reserve to solve economic troubles through interest rates cuts.

♻️ In the New Yorker, Bernard Avishai claims the U.S. has missed a big chance to enter a Green New Deal revolution.

🔎 Noam Scheiber and Kate Conger investigate on how Google manages internal dissent on ethical issues in a long article for The New York Times. Very recommended read.

🌱 Last week I wrote about ESG funds. Ron Lieber from the New York Times provides some suggestions on how to build a socially conscious portfolio.

🏭 In a four-part series about the purpose of B Corporations, Quartz analyzes how those companies can favor the transition to sustainable business.

Thanks for reading.

Please give me any feedback about this issue. If you enjoyed reading it, like and share Reshaped with potentially interested people.

Have a good weekend!

Federico