🌌 Reshaped #19

PE as a billionaire factory, Apple under attack, the inconsistency of the managerial class, Togo's welfare program and much more

Welcome to a new issue of Reshaped, a newsletter for those who do not want to miss a thing about the huge transformations of our time.

Antitrust is getting serious both in the US and the EU as Apple joins the club of companies under scrutiny for anticompetitive practices. In parallel, the European objective to tax digital platforms generating revenues in the continent is a source of growing concern due to the hostile reaction of Donald Trump, worried about potential consequences for the next presidential elections.

Do not forget to share Reshaped with your friends and colleagues!

New to Reshaped? Sign up here!

News

📱 The EU opened antitrust investigations over Apple Pay and the App Store for violating competition regulations (The Wall Street Journal). Specifically, Apple Pay is accused of limiting the possibility for rival payment systems to access an iPhone’s NFC to make payments. On the other hand, the App Store is the target of other tech companies like Rakuten and Spotify that complain about the high fees and entry barriers for ebooks and music respectively. Apple is facing similar critiques from Hey, Basecamp’s new email service, and Tinder. Meanwhile, the CEOs of Amazon, Facebook, and Google seem to be ready to testify before Congress about Big Tech market dynamics (NBC). All those companies are under scrutiny in the US and the EU because of their monopolies.

⚖️ The US abandoned the OECD negotiations with European countries regarding an international tax system (The New York Times). President Donald Trump fears a digital tax on (American) Big Tech could have negative effects on his chances to be reelected in November. However, the EU will continue with its plan to impose a tax between 2 and 6% on local revenues of those companies (Financial Times).

🛒 Walmart announced a new partnership with e-commerce leader Shopify to strengthen its online business (Financial Post). The objective of the retail giant is to increase the number of actors in its third-party marketplace to further reduce the gap with Amazon and reach profitability. Practically, Walmart would open its marketplace to Shopify sellers, aiming to add 1.200 SMEs to it within the year. This could be a serious challenge to Amazon, which is under scrutiny in Europe due to unfair competitive practices towards the independent sellers of its platform.

💊 Royalty Pharma raised $2.2 billion in the biggest IPO of the year (Bloomberg). The New York-based company, founded in 1996, is the largest buyer of biopharmaceutical royalties in the world and an active investor in biotech ventures. As shown by ZoomInfo and Vroom (and by the announced IPO of Palantir), the recovery of financial markets is pushing tech companies to go public (The New York Times), as the possibility of a second crisis due to the pandemic is still pressing executives to exploit the current positive trend.

🎲 SoftBank invested $500 million in Credit Suisse’s financial arm worth $7.5 billion (Financial Times). Curiously, Credit Suisse is among the investors of SoftBank’s Vision Fund. This is partially linked with my brief excursus on the emergence of venture debt, which you can find in the last issue of Reshaped. Meanwhile, as previously announced, the Japanese conglomerate will sell most of its T-Mobile shares to overcome the bad financial results of the last fiscal year (CNBC).

💵 Whatsapp will launch a payment system in Brazil linked with Facebook Pay (TechCrunch). Users will be allowed to exchange money through the messaging application for free, while businesses will be charged a 3.99% fee to receive payments.

🧲 A value extraction machine

A recent study by Oxford University Professor Ludovic Phalippou reveals that the performance of private equity (PE) funds is similar to that of public equity at least since 2006. In other words, high-cost and high-risk private equity investments returned almost the same as low-cost and low-risk public equity indices. As a consequence, there is no reason for the generous compensation schemes partners earn for generating profits for investors, as there is no superior value with reference to stock markets and other investment opportunities.

However, thanks to this compensation structure that is only apparently justified by returns on investments, PE partners managed to get rich at an incredible pace. Ludovic Phalippou calls it “the billionaire factory” and reports that the total number of PE multibillionaires went from 3 in 2005 to 22 in 2020. The “2 and 20” rule — 2% management fee on the total assets of the fund and 20% incentive fee on profits generated above a pre-established threshold — should be revisited to compensate for the value-added instead of profits. If other investment opportunities generate the same results, why should PE partners earn so much?

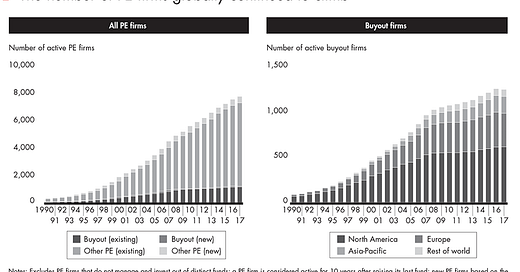

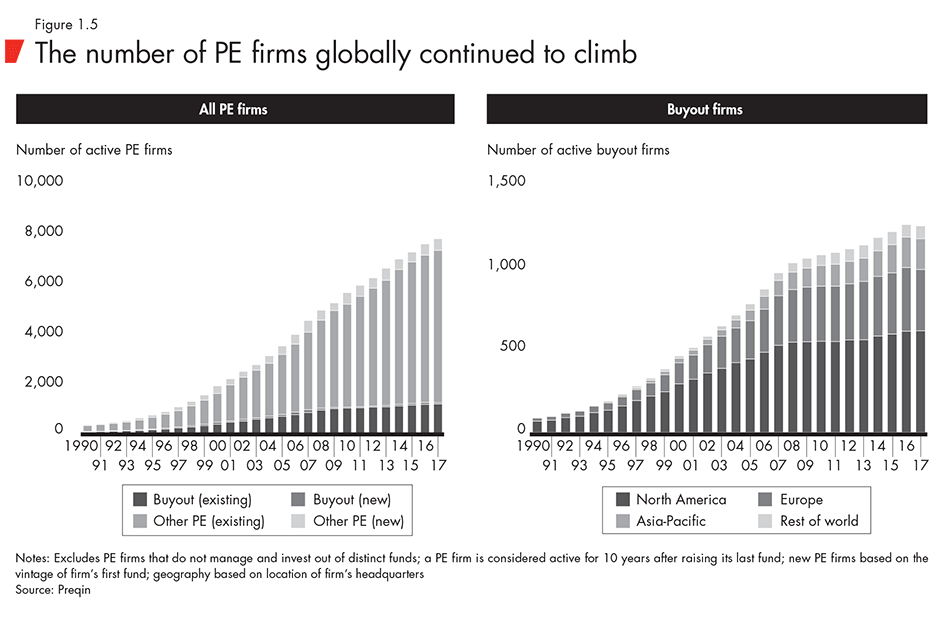

The study provides precious data to validate something everybody in business and finance knows quite well: PE is far from a value creation industry. On the opposite, it could be defined as the perfect value extraction machine. It developed during the 1980s as a result of the growing financialization of the world economy, as illustrated by UCL Professor Mariana Mazzucato in her latest book, The Value of Everything: Making and Taking in the Global Economy. The number of PE firms has been growing globally for the last four decades, in particular after the 2008 financial crisis (see charts below from a Bain report).

According to Phalippou, this inconsistency between value added and compensation emerges as a consequence of two main factors. First, PE is characterized by strong agency conflicts that are not solved through the incentive fees earned by partners. Second, there is low financial literacy among both principals and many agents, which are somewhat called “sophisticated investors”. A third factor I would add to this explanation is the friendly narratives promoted by financial and political actors regarding the benefits of private equity markets — despite being heavily criticized by a growing number of practitioners like Warren Buffett.

Rethinking our financial sector means not only regulating more strictly these investment activities or applying a better taxation scheme on capital gains. It means breaking this narrative with fairer competition and improved transparency in the financial sector. It means providing an easily readable evidence of the performance of each of those actors. And, not least, bringing back government investing for core development areas that cannot be left to the domain of pure speculation and end-of-oxygen bankruptcies — see the chart below from PitchBook, which shows the trend of bankruptcies of PE-backed firms.

Alternative perspectives

🤝 On Lapham’s Quarterly, Curtis White highlights the many contradictions of modern philanthropy, which is at the same time a fundamental actor in responding to the environmental crisis and a pure expression of those capitalist forces that have contributed to its spread.

In the end, the philanthropist’s philosophy is this: We are virtuous because we have money. We are virtuous for giving away some of it each year. We give money only to the best causes that fall within our mission. We will tell you what the best causes are. We are under no obligation to tell you why the best causes are the best. […] The great paradox of environmental philanthropy is this: How do philanthropic institutions founded on wealth and privilege seek to address the root source of environmental destruction if that source is essentially the unbridled use of wealth and privilege? […] The pattern now is: first the passionate work of grass-roots activists; then the foundations come in; and finally the reign of data and the wisdom of bureaucracies through which nature becomes little more than a technical balancing act, an engineering problem on a global scale.

💼 On Palladium, Nicolas Villarreal provides a brilliant analysis of the managerial class, which, he argues, cannot be considered as such. If you recognize yourself in the description at the beginning of the essay, this is probably going to be your best read of the week.

For today, however, educated professionals remain a cross-cutting group representing all of the major economic classes in our society, increasingly so the proletariat. Their cultural pathologies and highly visible role in crafting ideology make them an easy target, but they have no structural autonomy or agency—so far, anyway. Classes are not eternal categories of our universe; they are historically contingent and the result of complicated processes. It is possible to imagine we are living through the pre-history of the professional and managerial class. Something genuinely new might come about if educated professionals and intellectuals find a unique way to benefit from their position and begin to structure society according to their own logic. There are already signs that this kind of reimagining is ongoing.

Other readings

🎂 On Nikkei Asian Review, Katsuji Nakazawa examines the process of glorification of Xi Jinping’s ideology, which is particularly relevant after his 67th birthday. An unofficial rule of the leading party requires public officers to retire if older than 68, which means he could be forced to leave within a year. But an exception could be made if Xi Jinping manages to promote himself as a glorious leader, blessed with a once-in-a-century political ideology.

🩺 On American Compass, Matt Stoller provides a clear portrait of how market concentration threatens the capability of markets to perform efficiently, with a focus on the US medical industry.

💳 On Quartz, Yomi Kazeem explores how the government of Togo launched a program called Novissi to distribute cash. For all informal workers, heavily affected by the recession and out of the standard welfare system, Novissi provided digital money to overcome the immediate troubles caused by COVID-19.

💰 On The Hustle, Michael Waters describes the strange case of the American town of Tenino, which is issuing wooden dollars to be spent at local businesses to overcome the economic consequences of COVID-19.

📢 In a recent analysis on the CNN, Kerry Flynn analyzes the podcast business Spotify is trying to build and lead, a topic already covered in various past issues of Reshaped.

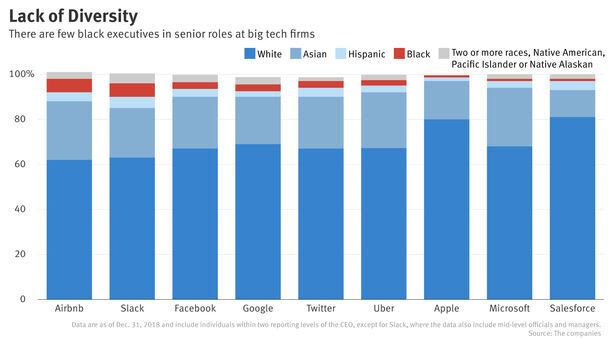

👉🏾 An interesting analysis by Cory Weinberg published on The Information reveals how many top roles in Big Tech companies are held by black people (see graph below).

Thanks for reading.

Please give me any feedback about this issue. If you enjoyed reading it, like and share Reshaped with potentially interested people.

Have a nice weekend!

Federico