🌌 Reshaped #11

Microsoft and open data, debt in the Silicon Savannah, getting bailouts right, the future of airlines and much more.

Welcome to a new issue of Reshaped, a newsletter for those who do not want to miss a thing about the huge transformations of our time.

As promised, this issue is slightly different from the previous ones — as I am still trying to find the best structure possible. I am looking forward to getting your feedback!

It was an intense week for Big Tech, as you will read below. The announcement that Microsoft is investing in open data has been largely underrated by major media, but I think it is a huge move in a hyper-competitive sector. I also enjoyed reading about the bad consequences of the spread of fintech solutions in Kenya (see the Alternative perspectives section below): it shows once more that, without strong social infrastructures, digital solutions cannot deliver their promise.

Every newsletter relies on word-of-mouth to grow: if you like it, please share Reshaped with potentially interested people in your network and press the like button above!

New to Reshaped? Sign up here!

Where we stand

💥 Microsoft announced a new campaign to foster the diffusion of open data. On Tuesday, Microsoft’s Chief IP Counsel Jennifer Yokoyama released an announcement to introduce the new Open Data Campaign, aimed at gradually reducing the data divide by fostering access to data worldwide. Through the ODC, Microsoft will improve its internal data sharing capabilities while partnering with open data movements all around the world. Potentially, this move could give Microsoft a relevant edge over Big Tech competitors like Google and Facebook, which strongly rely on their private databases. In addition, Microsoft would have the chance to extend its dominance in the software industry to meet the demand for new applications built around this new approach to data. However, by pointing the finger at the increased concentration of data in a few players mainly located in China and the US, Microsoft’s President Brad Smith explicitly longs for an even more radical corporate policy to position Microsoft as the good tech company. For more information on the relationship between value and openness of data, see this past issue of Reshaped.

🔎 Amazon used data about third-party sellers to develop and market competing products. A new report shows that Amazon employees used sales data from independent vendors to produce and sell private-label products. Third-party sales account for 58% of total sales on Amazon, a must-be channel for many companies worldwide. This unfair advantage is a direct consequence of the business model of the company, which is at the same time a sales platform and a producer of goods. While this ambiguity has been present since the emergence of chain stores in the 1950s, Amazon’s shares of e-commerce (see the chart below) and its monopolistic dominance of the market mean that it could virtually decide the degree of concentration of a market segment depending on its own interests, with enormous consequences on financial markets and global supply chains. From this perspective, antitrust can and should play a key role in the attempt to restore fairness in e-commerce.

🥕 Global coordination is needed to solve the pressing troubles of the food supply chain. According to FAO’s Chief Economist Máximo Torero, the measures taken to contain the spread of coronavirus failed to take into account their consequences on the global flows of food. Isolationism has made food more difficult to trade, while panic buying has brought an increase in wastes. Production is also affected by the reduced mobility of workers and the increase in the price of phosphate, a key ingredient of fertilizers. Consequently, there may be severe effects on food allocation in the months to come that could only be solved through a global effort of coordination.

💰 Bailouts are generating harsh debates. All around the world, governments are under pressure for the design and implementation of effective bailout programs. In the US, SMEs are complaining about the cannibalization of resources from big corporations, which have much more lobbying power, to the detriment of smaller businesses. Unfortunately, this led to a conflict among the economic actors hit the hardest by the current crisis — a situation that was easy to foresee and could be easily solved through new, appropriate measures. However, in front of the threat of unemployment and continued shutdowns, some even question the efficacy of these allocations, especially in the case of airlines (see below). In a recent report, the Brussels-based think tank Friends of Europe has outlined five guiding principles for designing bailouts: the social usefulness of the business, the ownership structure of the company, the impact of bankruptcy on consumers and stakeholders, the greener footprint resulting from bailout conditionalities, and the positive impact on inequalities. As I analyzed in a previous issue, it is fundamental that the first condition (social usefulness) is applied also to startups, which are experiencing a relevant financial earthquake that will reshape their way of doing business and manage money. Even VC investors admit there is no rationale to allocate money to startups during the coronavirus emergency — except for those with a huge potential for the progress of society, which should be backed by governments anyway. VC funds have the capability to support the short-term needs of startups; SMEs, however, cannot enjoy this private financial support in any way. I will dive into the dynamics of the venture capital industry during the pandemic in the next issue of Reshaped.

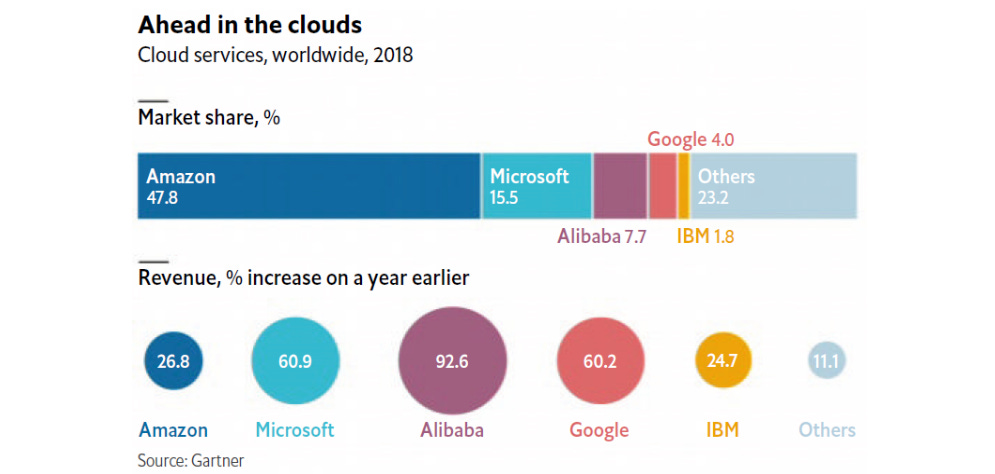

☁️ Alibaba will invest $28 billion in cloud technology in the next three years. The Chinese giant has a small share of the market for cloud services (see the chart below from The Economist), but also a huge potential to serve the national economy. Investments will mainly improve existing operating systems, servers, chips, and networks.

⛽️ Oil prices fall, but extraction continues. The main factor behind the historically low price of oil this week is the shock in demand. In turn, the fall in demand for oil is mainly related to the radical decrease in consumption from transportation services, which account for roughly 60% of global crude oil demand. However, production is not going to stop. According to Samantha Gross, the cost of stopping and restarting production are too high and prices could fall as a consequence. Moreover, some companies and national producers like Mexico bought insurance to prevent such a situation, which makes them more resilient in the short term and less willing to stop production.

✈️ Airlines could not survive despite bailouts. It is difficult to imagine the future of airlines beyond the huge bailout granted by governments all around the world. The contractions in transportation businesses could have permanent effects on international movements for years. As highlighted by Jorge Guira, Associate Professor in Law and Finance at the University of Reading, we cannot estimate properly how many months the current emergency will last, which makes it hard to evaluate the nature of the crisis of the sector — that is, a crisis of liquidity or a crisis of solvency. Hence, current bailouts are a jump into the unknown, even if necessary to prevent mass layoffs and the fall of an entire industry. Due to the large amount of cash spent by US carriers in stock buybacks, the minimum condition to apply should be to stop any stock repurchase (forever) and dividend payment (for some years). Governments should also retain an option to nationalize the company to prevent the outcomes of the worst-case scenario — namely that it would fail in any case, independently of the financial support provided.

Other news

💶 EU leaders agreed on a recovery plan worth €1 trillion linked to the EU's long-term budget (BBC). However, relevant divisions persist among countries (The New York Times), especially regarding how to fund the plan (Politico).

📱 In order to work properly, tracing apps based on Bluetooth technology need more data and a lower margin of error (MIT Technology Review). For a comprehensive review of how the app developed by Apple and Google would work, take a look at this excellent post by Jaap-Henk Hoepman.

⛔️ Democratic U.S. Representative David Cicilline has recently proposed to block any merger or acquisition until the end of the coronavirus emergency — except for companies that would go bankrupt otherwise (Reuters).

✂️ Google will cut its marketing budget by 50% and reduce hiring in the second half of 2020 in order to mitigate coronavirus consequences (CNBC).

🦠 Due to inequalities, Coronavirus is having greater effects on African Americans, often left out of basic healthcare (National Geographic). The situation is even worse in refugee camps all around the world, where social distancing is often impossible (Nature).

🦌 Releasing herds of herbivores (horses, bison, and reindeer) in the Arctic could help fighting climate change since animals make permafrost more resistant to gradual thawing (CBS News).

Alternative perspectives

🌾 In a recent article published on The Baffler, Felipe De La Hoz explains the paradox of undocumented agricultural workers in the US, who are at the same time illegitimate and essential for the economy. To some extent, the coronavirus crisis could help make them recognized as a vital component of the American economic system.

If undocumented workers inhabit an American underclass in ordinary times, it will be orders of magnitude worse as they’re battered by the cratering economy with access to practically zero of the pandemic-related aid and assistance. Of an already very limited slate of powerful champions in government and society, how many will remain once some twenty million laid-off Americans flood back into the labor market in unison? There’s a better-than-average chance that when the smoke clears, the workers who fed this country in its time of greatest need will find themselves bruised and alone, their crucial contributions easily cast aside as the administration, smelling blood, closes in.

📲 In an article on Boston Review, Kevin P. Donovan and Emma Park examine how the spread of digital lending mobile apps is increasing the debt of the poorest citizens of Kenya (the “Silicon Savannah”), who struggle to repay even small amounts due to high borrowing costs.

Indeed Kenya’s new experience of debt is worrying. It reveals a novel, digitized form of slow violence that operates not so much through negotiated social relations, nor the threat of state enforcement, as through the accumulation of data, the commodification of reputation, and the instrumentalization of sociality. Kenyans are being driven into circuits of financial capital that are premised not—as the marketing would have it—on empowerment, but on the profitability of perpetual debt. The eruption of over-indebtedness in Kenya marks the intersection of a faith in finance to ameliorate the lives of the poor and a recognition by techno-capitalists that those same populations are the source of runaway profits.

Other readings

👓 In our lives, we are often pushed to stay ahead of the technological wave, always ready to be early adopters of new stuff. On The Wall Street Journal, Robbie Shell explains how retirement has finally put an end to the rush.

📉 On ProMarket, Matt Stoller analyzes how private equity, heavily indebted and reliant on periodic bailouts, could be living its Minsky moment. Is it the end of an unsustainable business model?

🌲 On The Conversation, Alan Simson makes the case for better management of urban trees among tree managers, community members, and businesses to rethink urban areas in a more sustainable way.

🧳 Rich Americans are activating their escape plans to survive the pandemic, with an increased interest in New Zealand bunkers (Bloomberg).

Thanks for reading.

I will dedicate the next issue to analyze the impact of the current shock on VCs. I have gathered many insights from various professionals in the past weeks and I hope you will enjoy the analysis. If you have any contribution to the topic, do not hesitate to contact me by answering this email.

Please give me any feedback about this issue. If you enjoyed reading it, like and share Reshaped with potentially interested people.

Have a good weekend!

Federico